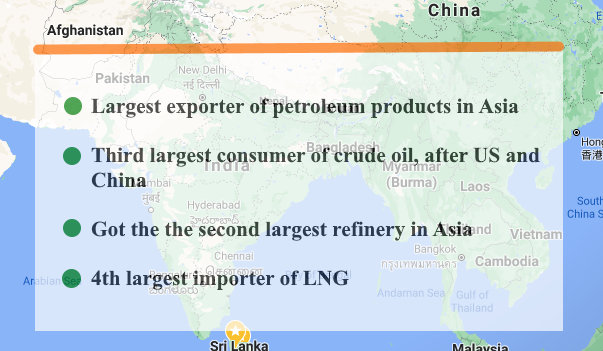

Rising Oil Price: world's third largest consumer feels the pinch

The rising oil price has already affected the world’s third largest consumer of crude oil, India, both economically and politically. During the last six months, fuel price has gone up by a staggering 23%, taking its toll on the freight operators with a significant rise in the cost of rentals. Since most of the internal transport of goods depend on trucks on networks of highways in this vast nation, the cost of goods for ordinary people is going to skyrocket in the far away regions, if the fuel hike continues at this rate – in proportion to the obvious increasing transport cost; India population is mainly rural and how they live – and spend - really matters when it comes to its economy. Indian economy that showed an impressive growth for decades suddenly came to a screeching halt due to the pandemic; for the first time in 70 years, it went through its worst recession. Although, it is showing the signs of a feeble recovery, the rise in the price of fuel on recent scale could