The price of crude oil recovered on Monday defying

the worst-case scenarios as the world still needs oil to function in a normal

way. As of 15:00 GMT, the prices of WTI and Brent were $71.88 and $75.77 respectively.

Most analysts hoped that the prices would recover

gradually; many, however, did not…

Monday 29 November 2021

Sunday 28 November 2021

Responsibility of the OPEC+ after the oil price crash: will there be a more pragmatic apporach next week?

. With the discovery of the new variant of Covid-19

virus, Omicron, the prevailing optimism in the energy sector has started

evaporating, almost mimicking dew on a leaf on a calm summer morning. It was a bolt from the blue, indeed; it, once again,

demonstrated how vulnerable we are despite the advent…

Saturday 27 November 2021

Plummeting oil price leaves the OPEC+ in a slippery lurch

The price of crude oil fell precipitously on Friday

when analysts were gauging the combined impact of the joint release of

petroleum reserves and the discovery of new Covid-19 variant in Southern

Africa. As of 18:00 GMT on Friday, the prices of WTI and

Brent were $68.15 and $72.72 respectively. When…

Wednesday 24 November 2021

Gauging the oil price trend when two factors competing for dominance

The price of crude oil slightly dipped on Wednesday,

in line not necessarily with the cumulative release of the SPRs, Strategic

Petroleum Reserves, by the top global consumers. The drop coincides also with the latest data

released by the API, American Petroleum Institute, which showed yet another US…

Tuesday 23 November 2021

Oil price: will the joint release of SPRs produce the desired outcome?

Crude oil investors are bracing themselves for the ‘big

news’ in the form of a public announcement by the world’s most powerful man in

the evening, with regard to the steps taken by his administration to cut down

on rising energy prices. Everyone expects that President Biden will address

the issue w…

Monday 22 November 2021

Oil Price: relasing SPRs amidst waves of Covid-19 surges in Europe

The price of crude oil that has been falling during

the past three weeks recovered slightly on Monday when the markets opened for

the business for the new week. As of 11:45 GMT, the WTI and Brent were back in the

green, both standing at $76.08 and $79.00 respectively, recording modest gains.

The pri…

Friday 19 November 2021

Joint release of SPRs and Covid-19 flare-ups in Europe bring down the price of crude oil

The price of crude oil continues to fall on Friday

as the news of the joint release of Strategic Petroleum Reserves, SPRs, started

gathering momentum, although there is no official response in this regard from

any country involved in the unprecedented move. As of 15:30 GMT, price of WTI and Brent st…

Thursday 18 November 2021

Oil Price: Is the US planning a collective SPR onslaught to tame the crude oil markets?

The price of crude oil tumbled on Wednesday in the

aftermath of Biden-Xi talks that took place virtually on Tuesday. Although both sides were tight-lipped about what

were under discussion during the three-and-half-hour long conversation, the

Chinese media started guessing the contents in dribs and d…

Tuesday 16 November 2021

Oil Price: Arctic blast across northern Europe may push the price up - further

An Arctic blast is set to hit the northern Europe in

the next few days, making both the temperatures and the continent’s cumulative natural

gas supply plummeting in a significant way. The above weather model shows how the extreme

weather front is moving across the region in the next few days. The pr…

Sunday 14 November 2021

The reluctance of Biden administration to tap into SPR: a litmus test to gauge the success of the talks on the JCPOA!

The price of crude oil has been falling for three

successive weeks and analysts attribute it to a series of factors, ranging from

strong dollar to loss of consumer confidence, especially in the major

economies. When the markets closed on Friday, WTI and Brent

stood at $80.79 and $82.17 respectively. …

Thursday 11 November 2021

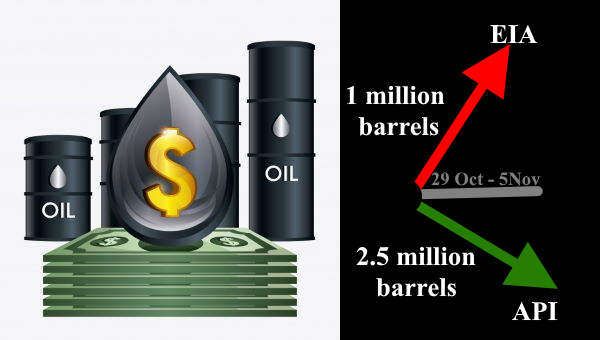

Oil price continues to rise between two contradictory US inventory reports

The inexplicable fluctuation of crude oil continued

on Thursday, perhaps fuelled by the anticipation of a potential move by the US

to calm the crude oil markets. As of 14:45 on Thursday, the price of WTI and Brent

were at $81.83 and $83.19 respectively. The US crude oil inventories, according to the …

Wednesday 10 November 2021

Crude oil price went up due to fallen US crude inventories

The US crude oil inventories dropped during the last

week, having been on the rise for six successive weeks, while defying the logic

of analysts. The API, American Petroleum Institute, reported on

Tuesday that the US crude inventories fell by 4.585 million barrels, exceeding

the expectations; the fo…

Monday 8 November 2021

Plummeting temeratures in China adds more pressure on energy markets

The price of oil and other commodities is one of the

hot topics in the corridors of power in the world, regardless of the economic

status of the country in question, because the rising price of oil, gas and

coal have already taken its toll on the recovery of the global economy as a whole,

despite t…

Sunday 7 November 2021

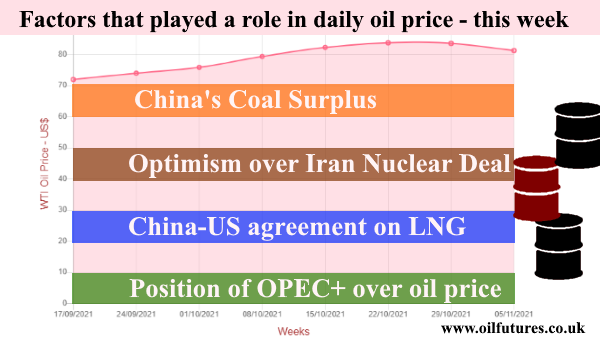

Factors that moved the crude oil price this week

Oil price fell slightly this week, having been

through unprecedented uncertainty. It, however, neither fell disastrously nor

increased dramatically due to outbreaks of the Delta variant of the Covid-19

and projected recovery in global demand respectively. The sole focus of attention was on the OPEC+…

Wednesday 3 November 2021

What caused the significant fall in crude oil price on Wednesday? There may be more than one reason!

The price of crude oil recorded a relatively sharp

fall on Wednesday, defying the ‘prophesies’ of certain investment banks. As of

16:00 GMT, the price of WTI and Brent stood at $80.82 and $82.04 respectively,

a fall of more than 3%. The key reasons behind the fall of oil price may be

the following: C…

Subscribe to:

Posts (Atom)

Search for Articles

Popular Posts

-

On a determined mission to turn their back on Russian oil and gas, the European countries are simply staring into an abyss of uncertainty in...

-

The negotiators from Iran and the rest of the signatories to the JCPOA, 2015 nuclear deal, are back in Vienna, the Austrian capital, to r...

-

The sudden announcement by the OPEC+ - OPEC plus Russia - took us, the mere mortals, by surprise and it was a bolt from the blue, indeed. T...

-

Judging by the reaction on impulse, the production cuts announced by the OPEC+ on Wednesday, has clearly left the Biden administration of ...

-

Crude oil price that has been rising for the past three weeks at a slower, but steady rate, appears to be facing a formidable ceiling to s...

TOP CATEGORIES

Labels

Crude Oil Prices

(513)

Global Politics & Energy

(513)

Crude Oil Prices

(7)

featured

(4)

Gas Prices

(518)

Global Politics & Energy

(8)

Oil & Gas Market Analysis

(519)

Blog Archive

-

▼

2021

(261)

-

▼

November

(16)

- Oil price makes swift recovery defying the doom an...

- Responsibility of the OPEC+ after the oil price cr...

- Plummeting oil price leaves the OPEC+ in a slipper...

- Gauging the oil price trend when two factors compe...

- Oil price: will the joint release of SPRs produce ...

- Oil Price: relasing SPRs amidst waves of Covid-19 ...

- Joint release of SPRs and Covid-19 flare-ups in Eu...

- Oil Price: Is the US planning a collective SPR ons...

- Oil Price: Arctic blast across northern Europe may...

- The reluctance of Biden administration to tap int...

- Oil price continues to rise between two contradict...

- Crude oil price went up due to fallen US crude inv...

- Plummeting temeratures in China adds more pressure...

- Factors that moved the crude oil price this week

- What caused the significant fall in crude oil pric...

- With the Revival of the JCPOA in Jeopardy, Crude ...

-

▼

November

(16)