The rising

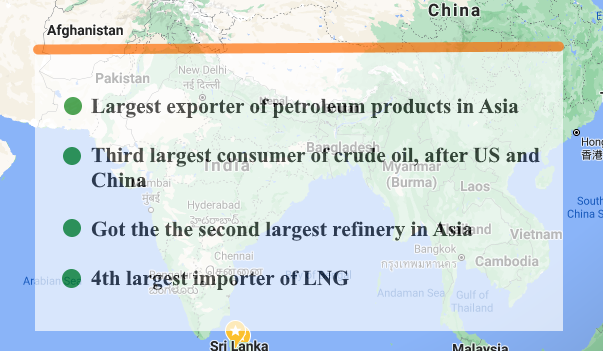

oil price has already affected the world’s third largest consumer of crude oil,

India, both economically and politically.

During the

last six months, fuel price has gone up by a staggering 23%, taking its toll on

the freight operators with a significant rise in the cost of rentals.

Since most

of the internal transport of goods depend on trucks on networks of highways in this vast nation, the

cost of goods for ordinary people is going to skyrocket in the far away

regions, if the fuel hike continues at this rate – in proportion to the obvious

increasing transport cost; India population is mainly rural and how they live –

and spend - really matters when it comes to its economy.

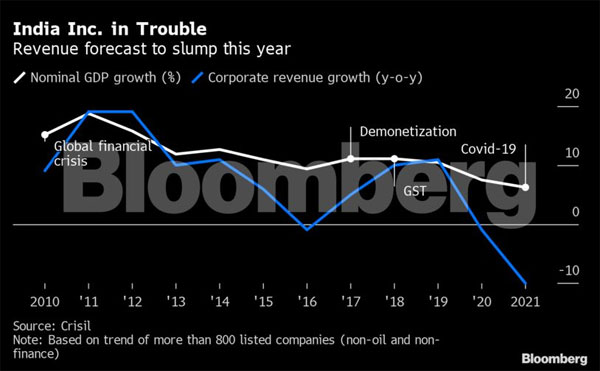

Indian

economy that showed an impressive growth for decades suddenly came to a

screeching halt due to the pandemic; for the first time in 70 years, it went

through its worst recession.

Although, it

is showing the signs of a feeble recovery, the rise in the price of fuel on

recent scale could potentially hamper it considerably. Both Saudi Arabia and

the UAE increased the fuel price for Asia, the region with the world’s second

and the third largest consumers of crude oil and the impact has been enormous.

Against this

backdrop, Indian finance minister came up with her budget this month with the

focus mainly on infrastructure and health care. The government came under fire

from the opposition for this approach.

One of the

highlights in the budget was relatively insignificant increase on defence. By

coincidence, both India and China agreed to pull back their troops from where

they are right now to where they were years ago – a sign of reconciliation after

months of sabre-rattling near the LAC, the line of actual control of the

disputed border.

In another

development, India and Pakistan agreed to observer the ceasefire agreement

signed between the two nuclear-armed nations in 2003.

The peace

overtures by India towards its neighbours show that India has very little room

for manoeuvre when it comes to reviving its economy, which was once the envy of

the developing world.

In this

context, the rising fuel costs can create friction against the growth engine, hampering

its forward march.

Since India

is a major consumer market for the world as well, its slow growth can cause

ripple effects on every single major market too.

That’s why

economists watch India’s moves to get its growth back on track at a very

difficult time – with a heightened interest.