Oil World

The World of Oil

If the world of oil is a pyramid in a metaphorical sense, its base was formed millions of years ago, according to scientists. According to them, dead species, both plants and animals - especially those of marine-based - were crushed by the sheer pressure and the influence of heat, while lying buried deep inside sands, rocks and silt.

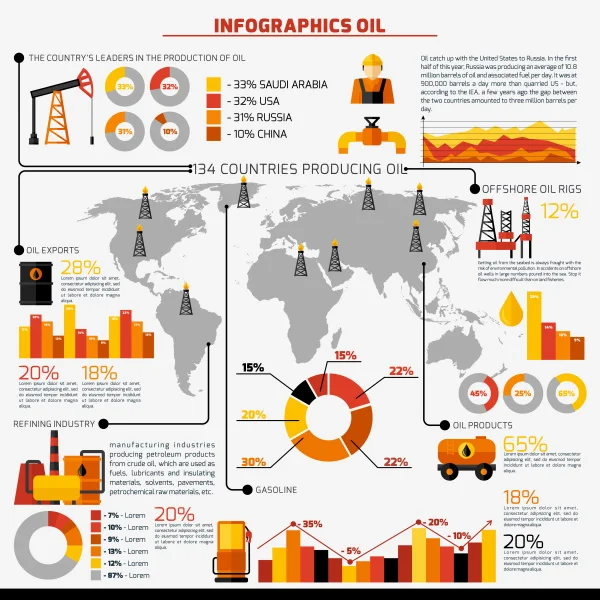

Natural gases and petroleum products, thus formed, are below the surface of the Earth and inside the cavities of sedimentary rocks. Crude oil is one of the important products from these deposits and it is extracted and brought to the surfaces for refining. During the process of refining, various petroleum products are separated from crude oil in line with requirements of the production company in question. Some of them are as follows:

- Gasoline

- Diesel - distillate

- Jet Fuel

- Light

- Heating Oil - distillate

- Lubricating Oil

- Waxes

The World of Oil in Grpahics

|

| The World of Oil |

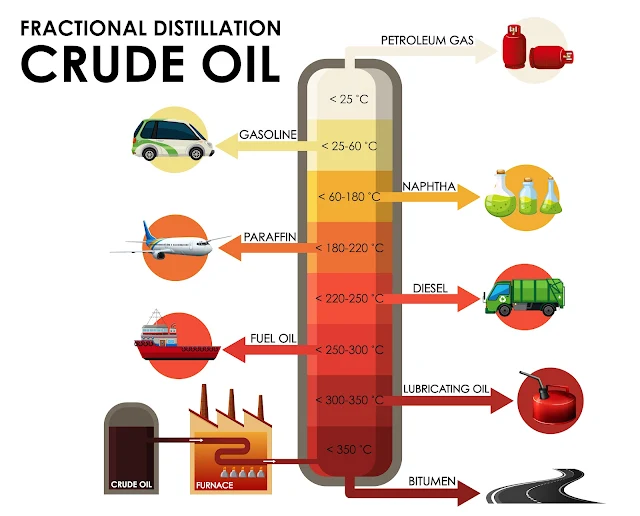

Fractional Distillation of Crude Oil

Crude oil consists of various hydrocarbons. Through the process of fractional distillation, these hydrocarbons can be separated. They are as follows:

- Heating crude oil

- Creating a temperature gradient along the column with the highest temperature at the bottom and the lowest at the top

- Hydrocarbons with higher boiling point - longer hydrocarbon chains - condense first - to be collected form outlets near the bottom

- The shorter hydrocarbons have relatively low boling points and move up along the column - mainly gases

Oil Price and Global Factors

As in every commodity that people deal with on daily basis, the price of crude oil too, in the end, is determined by supply and demand. The obvious evidence for this fact is how the price stagnated during the coronavirus lockdown, when there was an over-supply of the commodity. These are the factors that affect the oil price at present.

- Inventory count or the level of inventories

- Growth of Industrialized economies

- The onset of Winter and Summer in the developed nations

- Collective production targets set by the OPEC - Organization of Petroleum Exporting Countries

- Geo-political developments

The EIA - the US Energy Information Administration - maintains weekly change in the inventories of crude oil held by firms in the US, in terms of barrels. The change really reflects the state of the economy for obvious reasons: the increase in inventories is inversely proportional to the demand; the greater the demand, the slower the increase in inventories.

The economic growth of major industrialized nations directly affects the price of oil, as the need of oil for transportation, running machinery and increased industrial goes up in direct proportion.

As far as seasonal changes are concerned, the onset of winter in the developed nations means that the demand for crude oil invariably goes up, as the heating oil must be transported to the regions to address the demand. On the other hand, when summer approaches, the process reverses, unless an unusual weather event changes the usual patterns.

In addition, the developments in the OPEC can influence the price of oil: in the short-run, the sentiments can have an impact on the price of oil; in the long-run, if they agree to a cut in production to shore up the price of oil, the impact cannot be underestimated. Fortunately, it is the individual member that ultimately decides about the true production cut, according to the historical evidence.

Last, but not least, is the role of geo-political events in the price fluctuations of crude oil. Some developments, such as terrorist attacks, have a short-term effects; the potential for long-running war, on the other hand, have serious long-term effect on the price of oil.

Seven Factors that Determine Crude Oil Price

The EIA, based on its enormous experience in the field, has identified seven factors that determine the price of crude oil. They are as follows:

- Supply by the OPEC members such as Saudi Arabia, UAE and Iraq.

- Supply by non-OPEC members such as Brazil, Oman and Russia.

- Demand by OECD countries such as UK, Switzerland and Sweden.

- Demand by non-OECD countries such as Argentina, Malaysia and India.

- Balance - when production outstrips demand, the excesses go to inventories - to be stored for future use; the size of inventories, therefore, affects the oil price.

- Spot prices - the price of different type of crude oil in the global markets

- Financial markets - the role of primary actors such as buyers and sellers, secondary actors such as banks, airlines and those who work on the periphery such as analysts and forecasters.

Primary Benchmarks of Crude Oil

A benchmark crude is a crude oil that acts as a reference price for both buyers and sellers of crude oil in the global markets. There are three primary benchmarks at present.

- WTI - West Texas Intermediate - mainly in the US; light and sweet(with low sulphur content)

- Brent Blend - mainly used in Europe; relatively high in sulphur content and heavy

- Dubai Crude - used in the UAE and Oman; high sulphur content and heavy