|

| Oil prices in November: Impact of Iranian and Venezuelan Contributions |

The price of crude oil dramatically declined this week despite the anxieties over the potential disruptions of the flow of the commodity from the Middle East.

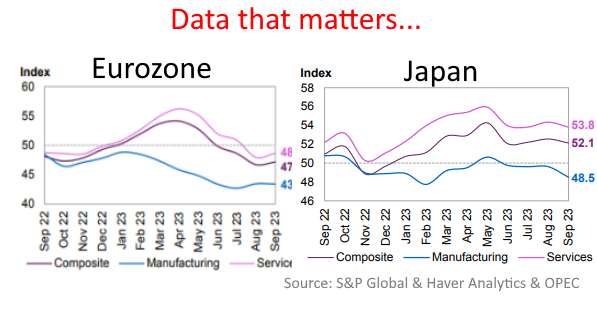

The fall in price came about as most economic indicators paint a gloomy outlook across the world: In October, for instance, China's Manufacturing PMI recorded an unusual decline, to be followed by China's honest admission that its manufacturing sector had shrunk; since China is the world's second biggest consumer of crude oil, the development is significand and oil investors react to it while exercising caution when it came to investing their money.

China is not the only country that feels the economic woes; the European Union and even Japan are in the same predicament; Japan, for instance, without its own oil reserves, is the fourth largest oil importer in the world.

The combined impact of the stagnating economic indicators appears to be overshadowing the obvious production cuts initiated by Saudi Arabia and Russia in order to boost the oil prices. Although the production cuts pushed the oil prices up initially, perhaps on the sentimental grounds, they are back at where they used to be, before the move was made by Saudi Arabia and Russia.

As of 12:10 GMT, the price of WTI and Brent were at $76.77 and $81.04 respectively. The price of LNG, liquified natural gas, also declined to $3.12.

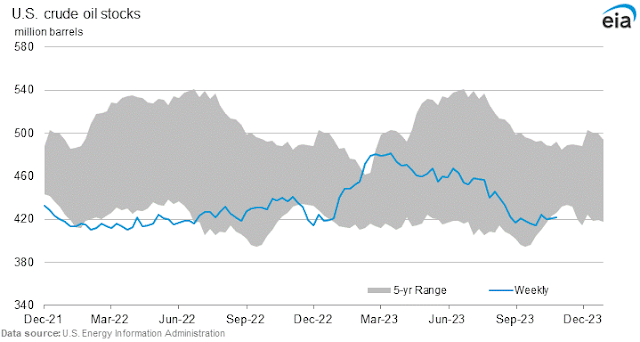

Reflecting the ground realities, the US crude stocks showed a significant build last week, according to the EIA, US Energy Information Administration; it was a drag on the rising oil prices too, in addition to the existing factors.

In order to stabilize the oil prices, meanwhile, the US made two political moves, defying the political risks: on one hand, it allowed Venezuela to sell its oil in the international markets; on the other hand, it took measures to hit Iran really hard by passing a special bill, SHIP - Stop Harboring Iranian Petroleum - in the House of Representatives 342-69, dealing a heavy blow to the Iranian petroleum industry, when the latter can hardly afford to absorb such a move.

The bill prohibits any refinery or port to process Iranian crude oil, violation of which would lead to punitive measures being imposed by the US against the would-be violators.

Iran had been under the US sanctions for decades: every year, the noose just gets tightened; yet, Iranians managed to get a substantial amount of oil into the global markets, defying the sanctions.

The US, despite being aware of the practice, stuck to the carrot-and-stick approach while trying to get Iran onboard in order to dampen the nuclear ambitions of the latter. In addition, the US liked the crude supply in the global markets on the up for obvious reasons.

The US, having failed to persuade the Saudis to increase the oil production, was forced to release oil from its SPR, Strategic Petroleum Reserve, to maintain the global oil prices at a reasonable level for both consumers and producers.

With the SPR at an all-time low, the US cannot do it anymore for a sustainable period defying political critics. Therefore, it either has to increase its own production or ask producers to do it for them. It turned to Venezuela for the same - as the last resort.

All in all, if the war in the Gaza Strip does not get any worse with more regional actors being sucked in, the price of crude oil will be determined by the factors that really matter - supply and demand, not the inflated sentiments.