At the outset, Mr Musk fired first salvo against bill by saying it cannot be both big and beautiful at the same time, for which President Trump avoided to respond.

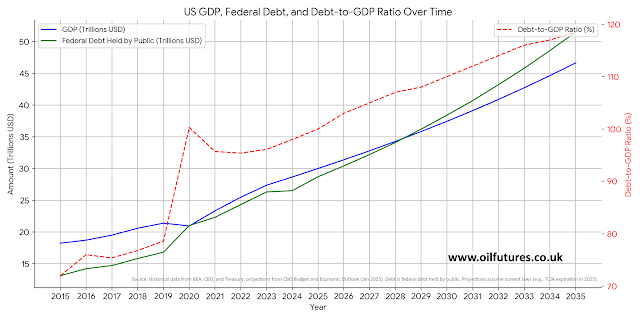

Mr. Musk, known for his advocacy in reducing the Debt-to-GDP ratio (which was 124.0% in December 2024 according to CEIC data, and projected to be around 126.80% in 2026), had openly expressed his displeasure with the bill.

The initial criticism from Mr. Musk, primarily through tweets, was tolerated by President Trump. However, when pressed by journalists at the White House on Thursday, President Trump's patience wore thin, leading to a public display of annoyance. This quickly devolved into a "tit-for-tat" exchange of accusations that bordered on personal insults.

The stakes in this public fallout cannot be higher. Loyalists of both figures are urgently calling for de-escalation, fearing severe consequences. President Trump, true to his threats, could potentially terminate SpaceX contracts and EV tax credits, which would deal a significant blow to SpaceX and Tesla, two of Mr Musk's primary companies.

The initial criticism from Mr. Musk, primarily through tweets, was tolerated by President Trump. However, when pressed by journalists at the White House on Thursday, President Trump's patience wore thin, leading to a public display of annoyance. This quickly devolved into a "tit-for-tat" exchange of accusations that bordered on personal insults.

The stakes in this public fallout cannot be higher. Loyalists of both figures are urgently calling for de-escalation, fearing severe consequences. President Trump, true to his threats, could potentially terminate SpaceX contracts and EV tax credits, which would deal a significant blow to SpaceX and Tesla, two of Mr Musk's primary companies.

Indeed, in the last few days, Tesla has already seen a loss of over $150 billion in market value due to investor concerns over the potential elimination of EV tax credits. For President Trump, the row risks alienating influential figures in Silicon Valley, which could negatively impact the Republican Party in future elections.

It remains unclear who will back down first, as both men are highly sensitive to personal criticism and possess substantial egos, making them reluctant to concede. Their history includes previous public fallouts, even over relatively minor issues. This current saga, stemming from a policy disagreement, quickly became personal, damaging the standing of both men. If not resolved through mutual compromise, this feud could also politically harm President Trump, as some Republicans might side with Mr. Musk on tax and spending issues.

This is not the first serious disagreement between the two powerful men. During the early stages of the 2024 presidential campaign, Mr. Musk initially supported Ron DeSantis, the current Governor of Florida, urging President Trump to step aside for a younger candidate. President Trump responded in his characteristic fashion. However, their relationship later saw a significant shift when, after President Trump miraculously survived a shooting at a rally, Mr. Musk publicly supported him, actively using his social media platform, X, to aid the campaign and contribute to its successful outcome. This history of fallouts followed by reconciliation offers some solace to their loyalists.

In a recent development, Mr. Musk has floated the idea of forming a third political party in the United States, positioning it against the Republican and Democratic parties. A poll conducted on his X account as of Saturday, June 7, shows strong support for this idea, with over 80% of more than 5 million Americans voting in favor. If a significant portion of Mr. Musk's 200 million followers were to engage, this initiative could indeed become a substantial political event. He has even suggested the name "The America Party."

It remains unclear who will back down first, as both men are highly sensitive to personal criticism and possess substantial egos, making them reluctant to concede. Their history includes previous public fallouts, even over relatively minor issues. This current saga, stemming from a policy disagreement, quickly became personal, damaging the standing of both men. If not resolved through mutual compromise, this feud could also politically harm President Trump, as some Republicans might side with Mr. Musk on tax and spending issues.

This is not the first serious disagreement between the two powerful men. During the early stages of the 2024 presidential campaign, Mr. Musk initially supported Ron DeSantis, the current Governor of Florida, urging President Trump to step aside for a younger candidate. President Trump responded in his characteristic fashion. However, their relationship later saw a significant shift when, after President Trump miraculously survived a shooting at a rally, Mr. Musk publicly supported him, actively using his social media platform, X, to aid the campaign and contribute to its successful outcome. This history of fallouts followed by reconciliation offers some solace to their loyalists.

In a recent development, Mr. Musk has floated the idea of forming a third political party in the United States, positioning it against the Republican and Democratic parties. A poll conducted on his X account as of Saturday, June 7, shows strong support for this idea, with over 80% of more than 5 million Americans voting in favor. If a significant portion of Mr. Musk's 200 million followers were to engage, this initiative could indeed become a substantial political event. He has even suggested the name "The America Party."

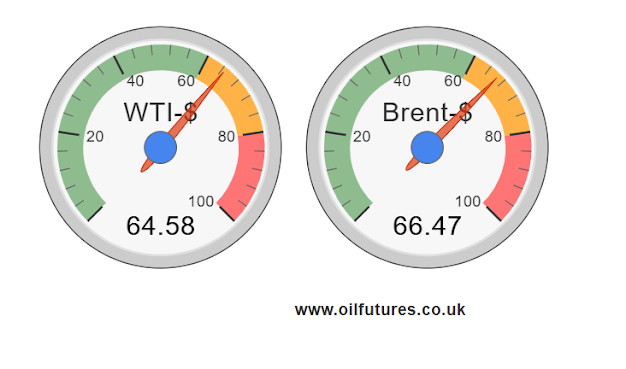

The energy markets are also feeling the impact of this feud. Concerns that EV funding might be cut could rattle the EV markets in the US and globally, leading to plunging sales of electric vehicles. In a worst-case scenario, this could push consumers back towards fossil fuel-powered vehicles if other choices become limited. In anticipation of these political developments, oil and gas prices have remained strong over the last few days as investors assess the situation in the United States.