|

| Venezuela oil export |

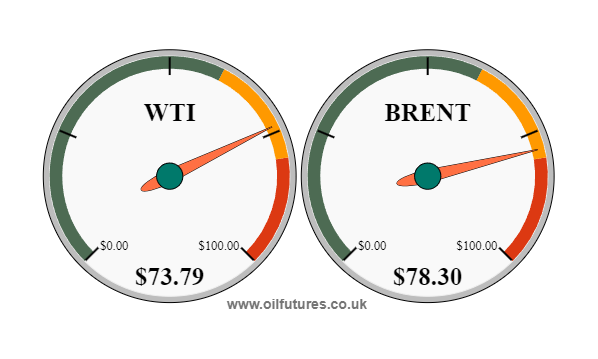

The pendulum of oil prices is back in the bearish territory, dealing a heavy blow to the ambitious producers in the OPEC+, mainly Saudi Arabia and Russia that tried in vain to push it to the polar opposite.

On Thursday afternoon, the selling price of crude oil fell almost by $8, with WTI and Brent recording $73.75 and $78.28 respectively; at some point, the price went down by over $2.

|

| Oil price on the decline |

Neither the war sentiment in Gaza nor the supply constrains applied to Iranian oil could push the price of oil up, defying logic.

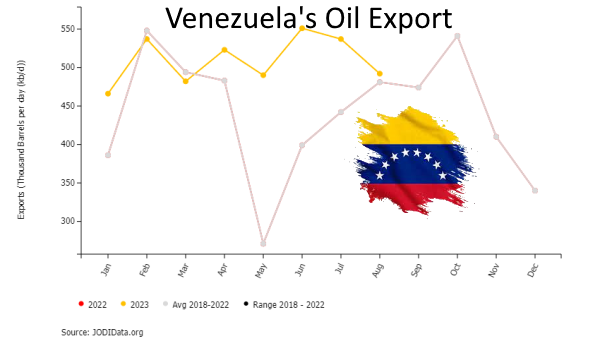

Although Venezuela is allowed to sell its oil now, years of sanctions, coupled with negligence and lack of investment, have taken their toll on its oil industry. Therefore, it is not feasible for Venezuela to make a swift, significant contribution to the oil markets.

From June up until August this year, the oil exports from Venezuela have, actually, declined. The EIA, US Energy Information Administration, estimates the oil output from Venezuela will be less than 200,000 bpd in 2024 despite the involvement of the US oil giants in extracting the commodity, thanks to the sanction waive introduced by the US in October for six months.

The improvements that need to be made to the oil infrastructure, according to the EIA, will take time. On the other hand, the Latin American country is supposed to hold free and fair elections for the continuation of the sanction waiver beyond the six-month period that ends in April, 2024.

Although the OPEC+ and IEA, International Energy Agency, expect the demand of crude oil to grow, the economic worries have cast a shadow over the optimism.

Against this backdrop, President Xi Ji Ping of China and President Biden met in the US, perhaps to explore the possibility of bringing about a thaw in the current frosty relations between the world's two largest economies; President Xi was reported to have said, "Planet Earth is big enough for the two countries to succeed, and one country's success is an opportunity for the other," during his conversation with President Biden.

President Xi must have meant the disastrous consequences on China's own economy - and on the US and the West in the long run - if the current tit-for-tat activities were to continue in the existing form. Chinas manufacturing growth has shrunk again in October, having recorded a modest growth since May, this year.

Saudi Arabia, meanwhile, is not open about its position on production cuts after December next year. It admitted that the profits of the main oil company, Aramco, have plummeted by over 23%, due to production cut that inevitably led to the falling sales; in order to mitigate the impact, Saudi Arabia has left the price of light crude oil to Asia unchanged.

The Saudis know that India and China will turn to Venezuela for crude oil if the latter sells it cheap. The move by Saudi Arabia to leave the price unchanged may have stemmed from a concern over the position of India and China in this regard.

Russia's oil revenue, meanwhile, has risen by $1.8 billion in September - the highest since July, 2022.

In this context, it is not clear at this stage whether Russia and Saudi Arabia see eye to eye on extending the production cuts beyond December in light of falling oil prices and the estimated contribution from Venezuela.