|

| China's Manufacturing PMI - October, 2023 |

At present, commodity markets are not short of uncertainties that constantly stem from the combination of the crises in the Middle East and of course, the sluggish, global economic outlook.

What they do not want is yet another anxiety on a different front. Unfortunately, that's what it really got this week, when China released it monthly data on manufacturing activities: it certainly is not encouraging at all; nor has it got anything to do with the two major wars that is raging in both Ukraine and the Gaza strip at present.

China admitted this week that its manufacturing activity contracted in October by 0.7% from what it was in September, having shown a steady growth since May this year until the last month.

The key metric that shows the Chinese manufacturing activities, Manufacturing PMI, was 49.5 in October, which was 50.5 in September just above the threshold, 50%.

The deceleration of manufacturing activity in the world's second biggest consumer - and importer - of crude oil is a significant factor that analysts in the realm take into account for their future calculations.

Although China has not accounted for the decline, it reflects the market realities that the Asian economic giant is facing with fragile global demand, despite being the most active player in the field, when it comes to manufacturing.

Investors in the energy markets often pin their hopes on Chinese manufacturing sector to gauge the demand for crude oil for months to come, when the demand from the US, the world's top consumer, appears to be fluctuating rather than giving a steady signal to the markets: the US crude inventories, both by the EIA and API, have not been showing any consistent pattern recently.

The relatively passive economic activities of the the top two global consumers of oil, in this context, leave investors in a nail-biting anxiety before splashing out their money on relevant stocks.

The war in the Gaza strip and the heavy focus on Iran as a country that sponsors the proxies involved in the crisis, meanwhile, are not making things easy for Iran to export its oil - its main revenue earner - in the international markets.

Although Iran claims that its oil exports are on the rise despite the crippling US sanctions, a top Iranian official contradicted the projected revenue from crude oil exports, by declaring that Iran has only managed to earn 70% of what had been estimated.

According to reports, the official in question has said that the estimates were based on the price of oil being at $80 a barrel and daily exports at 1.5 million barrels; neither of them has been met.

In this context, it is highly unlikely that Iran would directly get involved in the present war between Israel and Hamas: on one hand, its economy cannot afford to do it; on the other hand, even if the ruling class wants to make such a move, it is a monumental risk to ill-judge the public mood for such an adventure; it is not easy for a theocratic regime to judge the public pulse accurately, as the flow of information is always through the channels of the loyalists.

The Biden administration that tried for months to revive the JCPOA, Joint Comprehensive Plan of Action, also known as 2015 Iranian nuclear deal, to achieve a secondary goal - getting more oil into the markets from Iran - has finally given up on the move, especially in the current circumstances.

The US, instead, turned to its own backyard, in order to find a solution, when the US consumers started feeling the pain of rising oil and gas prices: the US allowed Venezuela to export oil on condition that it will hold free and fair elections in 2024.

Since the infrastructure of the oil sector in Venezuela is in dilapidated condition as a whole, whether the South American nation can address the shortfall in the markets remains to be seen, despite having the largest proven oil reserves in the world.

If Venezuela can produce oil as soon as practicable, the South American nation will not find it difficult to get prospective buyers; India, for instance, has already indicated that it would buy oil from Venezuela if it offers at cheaper prices - perhaps even cheaper than that of the Russian oil.

Indian refiners have already opted for cheaper Urals, moving away from more expensive Russian grades as discounts that both China and India used to enjoy are on the decline.

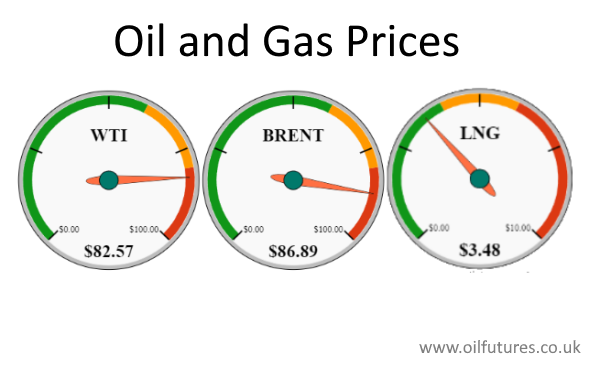

On Thursday, meanwhile, prices of crude oil reached just over $80 a barrel. As of 17:00 GMT, the prices of WTI and Brent were at

$82.57 and $86.89 respectively. The price of LNG, liquified natural gas was at $3.48.

Despite the escalating war in Gaza, energy prices remained relatively stable during the past three weeks. There are, however, signs of staring a second major front, if Hezbollah, the Lebanese Shite group, sticks to its rhetoric.

In response to the cross-border attacks towards Israel that was on the increase in the last few days, Israel said that it was ready to execute what it called, 'immediate Lebanese operation' - a coded reference for war with Hezbollah.

If that happens as feared, the palpable anxieties in the commodity markets will result in the rise in prices of oil and gas to worrying levels.