|

| Estimated oil production cuts in 2024 by country |

The OPEC+ meeting that took place yesterday, having been rescheduled for inexplicable reasons after four days, did not live up to the hype created by certain media about deepening production cuts. Nor did it achieve its intended goal, judging by the unusual market response in the aftermath of the meeting; the prices did not skyrocket this time!

The price of oil in the international markets on Friday, on the contrary, continued its downward trend, instead. Then, there are misgivings about the official communique, which at best, is vague in detail and at worst, leaves the analysists in a state of nausea, if they keep dissecting the material, phrase for phrase, in extracting the potential, exact numbers.

The markets expected additional cut of 1 million barrels; not only are the numbers announced far below that, but also voluntary; that means, the individual member of the OPEC+ has the freedom to choose - perhaps, not cutting any output at all.

It's no secret that there had been disagreements over the production quotas for three African nations - Angola, Congo and Nigeria. They wanted to increase the production to earn more revenue in order to address their own, dire economic needs. It has been reported that Angola was deeply unhappy over its allocated quota.

Despite the productions cuts, voluntary or not, oil prices hardly moved in the opposite direction as hoped by the bigwigs of the OPEC+.

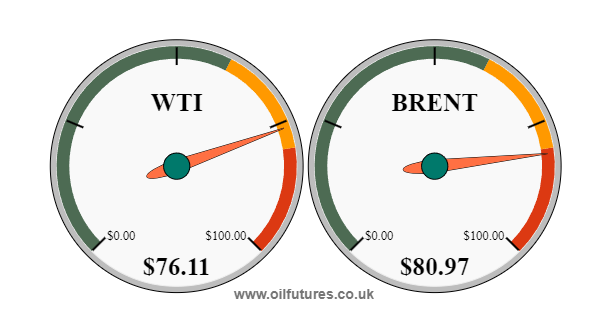

As of 11:25 GMT on Friday, the price of West Texas Intermediate, WTI and Brent, the international benchmark, were trading at $76.29 and $81.07 respectively.

|

| Hourly updates → https://www.oilfutures.co.uk/p/oil-futures-httpswwwoilfuturescouk.html |

In addition to the uncertainty of the voluntary production cuts, the economic factors compete the energy landscape in seeking the dominance: rising cost of living that defies the supposedly falling inflation, strong US dollar, rising interest rates and slowing global growth appear to be dashing the hopes of oil producers in cashing in on production cuts - and their effect.

The OPEC+, up until recently, was optimistic about the demand of fossil fuels in the coming years - at least in public; it even locked horns with the IEA, International Energy Agency, that contradicted the optimism of the cartel with a communique, titled, ' Moment of Truth': OPEC Secretary General, Haitham Al Ghais, in his response, said: “It is ironic that the IEA, an agency that has repeatedly shifted its narratives and forecasts on a regular basis in recent years, now addresses the oil and gas industry and says that this is a ‘moment of truth’. The manner in which the IEA has unfortunately used its social media platforms in recent days to criticize and instruct the oil and gas industry is undiplomatic to say the least. OPEC itself is not an organization that would prescribe to others what they should do.”

In fairness to the OPEC+, it must be said that the IEA has not been walking along a straight line with their forecasts either; for instance, it said that global oil demand will grow by 1.2 million bpd in 2024. This is a slower pace than the agency had previously forecast, due to the global economic slowdown.

The current status-quo is not good for the oil producers in general and the Middle Eastern producers in particular, because the latter have to prop up the economies by the revenue from petrodollars, in order to fund the generous welfare schemes for their citizens and diversify the economies; it's a tall order, though.

The latest estimate by the IMF, International Monetary Fund, for instance, shows that the Saudis must earn at least $86 per barrel to achieve their economic goals. At present, the price in question just hovers over $80 - or even below that; the situation, unless nipped in the bud, could lead to a budget deficit in the Kingdom.

In a separate development, oil producers that are not part of OPEC+ keep producing oil unabated, without being constrained by any undue influence. Even the US has increased its production by over 1 million barrels per day, according to the latest data.

In this context, if Saudi Arabia pursues its determination to cut down on production, there will be unintended consequences, ranging from losing its market share to causing dissension among some of the OPEC+ members, especially, those from the continent of Africa.

The fact that Saudi Arabia left the price of oil for Asia unchanged may have stemmed from the very apprehension of losing existing customers.

India, for instance, is keen to turning to Venezuela for its oil needs provided the former gets it cheap.

All in all, aggressive production cuts leave no country in a victorious position, as the rise in energy prices fuels inflation and it is a common enemy of both producers and consumers.

- HA -