|

| Bearish mood in the crude oil markets |

In proportion to the rate of optimism for a price rebound in the crude oil markets wearing thin, the hyperactivity of the stakeholders in the fossil fuel markets appears to be getting more and more intense by the day.

The seemingly-hastily-arranged state visit by President Putin of Russia to two major oil producers in the Middle East two days ago is a case in point.

Defying an international arrest warrant, Mr Putin arrived in the UAE and Saudi Arabia onboard Russia's own 'Air Force One', escorted by a fleet of SU-35S fighter jets.

Among the general issues discussed, according to both Russian and the Middle Eastern sources, were the wars in the Gaza strip, Ukraine, Syria and Yemen; in addition, the need of a constructive, collective move by the OPEC+ to stabilize the oil markets has been a major topic for discussion too, according to those who keep an eye on the development in the region.

Mr Putin, who received a grand welcome in the UAE with a fly-past, looked extremely relaxed in both countries among the beaming hosts; the development may not have gone down very well in the corridors of power in the Western capitals, though.

The fact that the UN resolution, proposed by the UAE for a ceasefire in the Gaza Strip, was vetoed by the US on Friday, in this context, appears to be a way that the US showed its displeasure over the UAE cozying up to Mr Putin; the UAE said it was disappointed with the US move that seemed to be a clear snub.

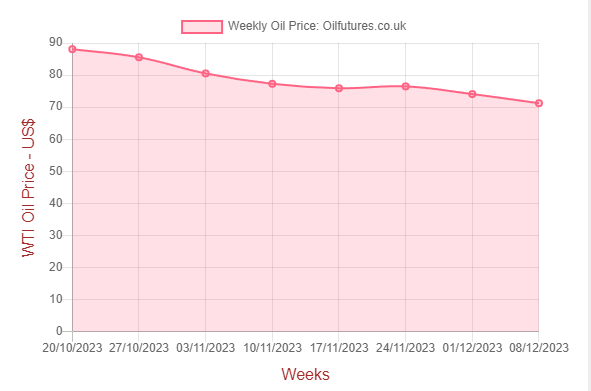

Despite the production cuts announced by the OPEC+, the price of crude oil, meanwhile, continued to fall during the past week, recording a 7-week successive decline.

Undoubtedly, the failure to boost the oil price by production cuts must have frustrated Saudi Arabia as the status quo is not sustainable as far as the world's top oil exporter is concerned; its break-even price is above $80, according to the estimates of the IMF.

In short, the unexpected development in the oil markets has placed the Kingdom between the rock and the hard place: production cuts generate less revenue, on one hand; on the other hand, by increasing the prices will force its longstanding, major customers to look elsewhere for cheaper alternatives; at present, Venezuela has been the focus of many major buyers in light of sanctions being temporarily lifted against its oil by the US.

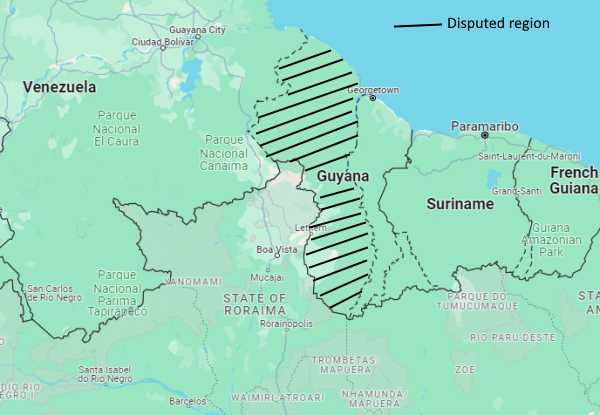

Venezuela, meanwhile, has been attracting more than its usual share of attention, as it threatened its relatively small neighbour, Guyana, of just 800,000 inhabitants over a disputed oil field: the ownership of Guyana’s Essequibo region has been in dispute for decades and the discovery of offshore oil fields that Guyana claims as its own territory has been the cause of the latest tension.

Venezuela conducted a referendum recently whether to pass legislation to declare the ownership of the region as its own and the outcome is said be over 95% in favour of annexing the region.

Venezuela, however, has neither international mandate nor backing for such a drastic move. If it were to go down this route, disregarding both legality and international concerns, the US will be compelled to read the riot act against the Latin American country - once again.

Judging by President Maduro of Venezuela's determination to claim the territory by driving away existing investors in the Essequibo region, the dispute may evolve beyond the bluster that in turn could affect the supply side of crude oil. The US has made its position clear on the matter and so has the International Court of Justice - ICJ.

Although the Venezuelan factor casts an extra canopy of worry over the energy markets, the existing worries show no sign of abating. The rampant inflation and the inevitable measures to counter it such as raising interest rates, for instance, has dampened the mood of the investors in the sector. It has the potential to further slow down the global economic growth that in turn affect the demand of oil.

The prevailing bearish sentiment is worrying the OPEC+ to the core and reaching an agreement over a sustainable level of production, in all probability, appears to be a major stumbling block.

The significant gap between the latest meeting and the one planned for the next year - June, 2024 - just reflects the potential difficulties faced by the members of the cartel, when it comes to determining the optimum production cut.

It seems to be a yawning gap to be bridged as far as the OPEC+ is concerned.