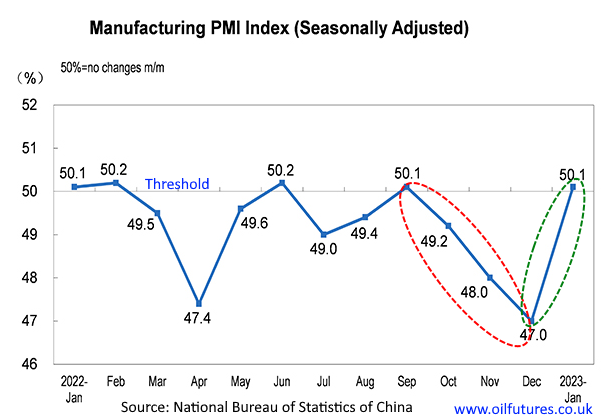

In the ascending order of the ladder of relevance, there seems to be some good news as far as the stability of the crude oil markets are concerned; China has reported that a key index that reflects its manufacturing activity did cross the threshold in January, defying the gloom and doom that used to do rounds in the past few weeks.

China's Manufacturing PMI index had been falling since September, clearly indicating shrinking activities, up until the trend reversed in January. It has crossed the psychologically-sensitive threshold of 50 and as of January in 2023, it stood at 50.1.

Crude oil markets will really welcome the news: China is the world's largest importer of crude oil after all and of course, the second largest economy in the world.

Understandably, when China sneezes, the rest of the world catches a cold - and it is inevitable. Analysts have been connecting the uncertainty in the energy markets, in part, to the slowing economic growth of China due to a myriad of factors.

In addition, China appears to be keeping the latest Covid-19 infections at bay, despite the media reports to the contrary; it has already relaxed the rigid rules that at times were branded as 'draconian' by some media as it included the restrictions on travelling, to and fro.

The excitement over the heightened economic activities in China, however, is yet to evolve into a sustainable, positive market sentiment. For instance, as of 13:30 GMT, WTI, Brent and LNG, liquified natural gas, were at $74.27, $81.13 and $2.45 respectively in futures markets - just a slight increase.

Analysts attribute the relative passivity in the markets to the lingering doubts about the global economy as a whole; that does not mean the increase in China's Manufacturing PMI index is just a flash in the pan, though.

Perhaps the time it takes for the confidence of the crude oil markets to build up, stems from the fact that China imports plenty of oil from Russia at rock bottom prices, partially staying away from the Middle East. India, the world's third largest importer of crude oil, has been doing the same, defying constant threats from the West.

As anticipated, the Spring Festival in China boosted its economy and of course, the corresponding sentiment as well, both locally and internationally. As a consequence, the price of crude oil rose for a few days, before coming back down when the resultant effect of negative factors weighed down on it.

On political front, however, there is no sign of improvement between the US and China, the world's two largest economies; on the contrary, they get worse. The accusations - and counter accusations - over a balloon is the latest escalation of tension between the two economic superpowers.

In this context, investors appear to prefer the wait-and-see approach to getting carried away over China's perceived economic growth. The lethargic rise of crude oil prices just indicates the fluctuating sentiment among investors.

The price of natural gas that has been influencing the price of crude oil, meanwhile, fell again in the afternoon in the markets despite the onset of North American winter storm affecting certain parts of the US, the world's top energy consumer. In the UK, the Met Office, is forecasting a two-day cold snap, due to which, the night time temperatures can go down as far as -60C; it has already happened, indeed.

Since the cold snap will be temporary - and fairly seasonal as well - investors believe that the probability of gas prices going sky high any time soon is very low, despite the reports of a yet another offensive by Russia against Ukraine; Europeans appear to be already having war-fatigue.

All in all, it will take a couple of weeks to see whether China's manufacturing boom can really lift up the mood in the energy markets, especially at a time when India, the world's third largest importer of crude oil - attracts more than its fair share of global attention due to Adani saga.