The prices of crude oil are heading for yet another weekly loss, as the conditions that first appeared to form a collective catalyst, are no longer viewed as strong as they were, when the sentiments started building up in the battered energy markets.

As of 15:30 GMT, the prices of WTI, Brent and LNG were at $77.79, $84.01 and $2.38 respectively.

The Chinese factor, for instance, has not gathered the momentum since the rigid lockdowns that had been in place were relaxed before the Spring Festival; in short, its perceived impact has been eclipsed by the persistent worries about the Chinese economy in particular and global economy in general.

The forecast of slow growth of the UK economy by the IMF is a case in point; adding insult to the injury, the Bank of England raised its interest rates - once again on Thursday; the ECB, European Central Bank, did follow suit, on Thursday; the Federal Reserve did the same - but by an amount smaller than first feared; the World Bank, meanwhile, has already revised down the global GDP growth from 3% to 1.7%.

As soon as the IMF made their forecast on the health of the UK economy, it did not go down very well with some of the MPs of the ruling class; nor was it well received by the media, publishing what they called, 'the track record' of similar forecasts by the global institution in the past - with less than glorious headlines, of course.

As far as the crude oil markets are concerned, the demand by China and India, the world first and second largest importer of the commodity - seemed to be robust up until last week. The status quo has since changed alarmingly in light of Adani saga.

Gautham Adani, the Indian entrepreneur, who is at an enviable position in a very damaging media storm at present, is losing his personal wealth and that of myriad of companies he owns, like a parachutist losing the upward drag; because of the scale of the involvement of Mr Adani in the Indian economy, both the finance minister and the head of the RBI, Reserve Bank of India, have been compelled to go public in order to assure the investors, both local and foreign, that the banking system remains safe.

Mr Adani's position as the most influential businessman in India, in part due to his association with Mr Modi, hailing from the same Gujarat state, has come under intense scrutiny in the international financial markets; his move to calling off the $2.5billion share sale was the biggest setback suffered by him in the middle of his meteoric rise in a matter of 10 years; at the time of writing this article, the value of his companies has fallen by more than 50% without an end in sight.

The concerns about the Indian economy will grow in mathematical proportion to the way Mr Adani tackles the issue.

As far as crude oil markets are concerned, India is a force to be reckoned with; it managed to import 28% of its oil from Russia, defying the threats by the West for doing so. That means, any adverse impact on the Indian economy by Adani saga is going to cause ripples in the energy markets too. In this context, the Chinese factor remains the main catalyst to shore up the markets.

The latest crude build, meanwhile, announced by the EIA, US Energy Information Administration, reflects the sentiments in the commodity markets; it reported a significant build of over 4 million barrels; it is the fourth successive build.

Although the crude build has lost its relevance in the recent months, when it comes to determining the price of crude oil for an extended period, it still is symptomatic of the lingering doubts about the global economy as a whole.

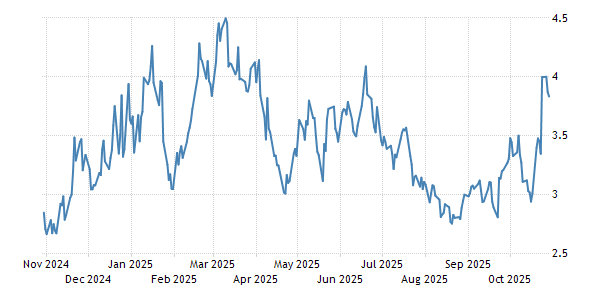

Moreover, the price of LNG, liquified natural gas, has been plummeting dramatically in the past two months: it has lost more than 77% since its peak in August, 2022; it would be a miracle, if it turned upwards in the next few weeks, as the temperatures in the northern hemisphere are rising and winter technically is coming to an end in four weeks.

As far as oil prices are concerned, the price of natural gas became a key factor that affects the demand in recent months; the high price of gas compelled many industrialists in the West to turn to oil as a cheaper alternative - as the last resort.

In this context, the fall of gas price is strongly linked to the fall of oil price - to some extent. That means the stagnation of gas prices will not boost the price of crude oil in the near future. As an inevitable outcome, the energy markets will remain in the doldrums for the next few weeks, if not months.

- HA, Crude Oil Futures -