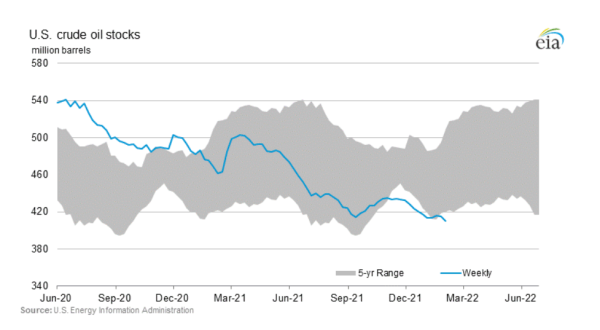

Although the

price of crude oil is hovering around $90 a barrel as of now, the US crude oil

inventories dropped for two successive weeks, implying that the demand is in

the recovery mode despite the surge in relatively mild Omicron variant of the Coronavirus.

The EIA, US

Energy Information Administration, reported that the US crude inventories fell

by 4.8 million barrels for the week ending February 4, on Wednesday.

Last week,

the EIA said in its weekly data release that the US inventories fell by more

than 1 million barrels.

The consistency

in falling US inventories helped crude oil markets to maintain the current

price levels, despite that being detrimental to the recovery of global

economies, battered by Covid-19.

For instance,

in India, the world’s third biggest consumer, the use of diesel fell by 12.8%

in January; since 40% Indian fuel consumption is diesel, its impact has been

widely felt by the country’s crude oil sectors.

Of course,

the state-wide curbs on the freedom of movement may have played a significant

role in the fall of consumption of fuel in India. Analysts, however, believe

the rising oil prices is factor behind the fall.

In addition,

the consumption of gasoline or petrol fell by 12.2%, which coincides with the

falling vehicle sales.

In light of

these developments, economists believe that high oil prices formed a drag on

the demand – and hopes of a full recovery. The growth in economy was also

affected during January, 2022.

In these

circumstances, Saudi Arabia raised the price of crude oil for the region – and beyond

– and the move will not certainly go down well with the Indian consumers as far

as the oil price is concerned.

Against this

backdrop, the US announced sanction waivers to Iran as a stepping stone to stand

and throw an anchor in salvaging the 2015 Iran nuclear deal; it has been oscillating

between hope and abject failure since the Biden administration started talks with

its Iranian counterpart.

Perhaps, the

US administration must have thought that the move would calm the crude oil

markets. Iran, meanwhile, is sticking to its guns demanding the removal of all

sanctions.

The tug of war

continues with both sides digging their heels and there is no sign of hope of

reviving the JCPOA, 2015 nuclear deal, at the present, despite the negotiations

being in the final stage.

Analysts are

watching the developments in Vienna where the talks take place, as it can

determine the direction of price movement of crude oil in the short-run pretty accurate.