The crude oil price fell on Thursday by a modest

amount despite the presence of encouraging factors that usually bolster it. As

this is the case, in order to catch a glimpse of the unexpected, it is worth

looking at the latest EIA report, analysing the impact of Covid-19 on the

Indian economy in general and petroleum sector in particular.

The reports depict a grim cumulative picture – much worse

than what we were led to believe.

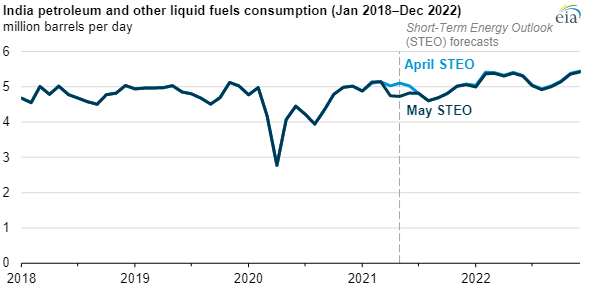

The petroleum consumption is down by 0.4 million

barrels per day; the loss of 8% led to the loss of 4million barrels in March

and April – a significant loss, indeed.

With the findings of the new data, the EIA, the

Energy Information Administration, has revised down its own earlier forecast

for India up until July.

The report cites the way the transport sector came

to a grinding halt during the latest wave of the pandemic in India, with a new

deadly variant that wreak havoc in much of India; the inevitable result was a

steep decline in the consumption of gasoline and diesel used in transportation.

The forecast of the EIA is clearly in line with the

data published by the PPAC, Petroleum Planning & Analysis Cell of the

Ministry of Petroleum and Natural Gas in India; the damage is all too clear to

see:

Google’s Covid-19 mobility report also backs up the

grim outlook in India, when it comes to the consumption of petroleum products;

it found a clear correlation between steep decline in mobility data and the

consumption of the diesel and gasoline.

On a positive note, the EIA expects that the demand

of gasoline and diesel will reach pre-pandemic levels by July – an assessment that

remains to be seen in light of the severity of Covid-19 being gradually on

decline in India.