The prevailing bearish sentiment in the oil markets does not seem to be shifting towards a watershed moment anytime soon in light of plenty of worrying economic indicators.

The Bank of England, for instance, increased the interest rates yet again on Thursday to 4.5%, from 4.25%, on the grounds of taming what it called, 'sky-high inflation'. The hike in interest rate, the 12th successive rise, is causing pain beyond the obviously-affected mortgage markets; no sector is immune to its impact.

With the unpopular rise in interest rates, the Bank of England tried to bury the bad news in a casket of spin, all to no avail; it said that the UK will not go into a recession this year. The consumer confidence, however, fell by the wayside yesterday despite the assurance over the recession by the boss of the Bank of England.

The degree of lingering anxieties in the energy markets went up by a few notches, when the hike in interest rate was announced. That, however, is not the only bad news as far as this particular market is concerned.

In India, the world's third largest consumer of crude oil, meanwhile, the demand fell by 10% from its March level, in April, according to the Indian media. It coincides with the price-cut for Asia announced by Saudi Arabia. Both Saudi Arabia and the UAE are fully aware of the inevitable attraction of the consumers to cheap Russian oil.

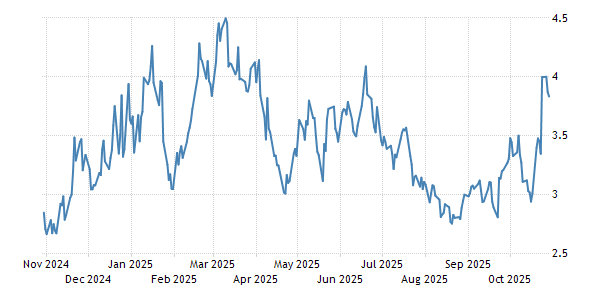

The oil markets were dealt yet another blow this week; the US crude inventories rose, having fallen for two consecutive weeks. Both the API - American Petroleum Institute and the EIA, the US Energy Information - reported a substantial rise in crude oil inventories, indicating a passive consumer enthusiasm.

|

| US Crude Oil Stocks - EIA |

This was not the only bad news that caused anxieties in the crude oil markets: the manufacturing activities in China, for example, has already fallen below the psychologically-and-economically-important 50% mark in April, indicating a contraction.

In natural gas markets, meanwhile, the price drop continues: the cumulative impact of sufficient storage, warming temperatures in Europe and America and an increased range of suppliers has brought down the price of gas by more than 85% since its highest in August 2022.

With gas prices at this level, the significance of Russian gas slowly pales into insignificance. Unless the war in Ukraine gets out of hand, there is very little chance of gas prices reaching record levels in the next few months. That means the price of crude oil is highly unlikely go above $80 in the foreseeable future.

Amidst the gloom and doom, however, there seems to be some encouraging developments on the political front: diplomats from China and the US, for instance, sat down together after a long period of time and agreed to move on, while branding the 'spy balloon incident' as unfortunate; the relations between Australia and China, meanwhile, are on the mend too, paving the way for restoring trading ties.

These developments come at a time, when there are clear indications of the US and its traditional allies in the Middle East drifting apart; the latter have even snubbed the former by restoring ties with Iran and even Syria on the basis, come what may.

In addition, there are serious moves to ditch dollar as the default trading currency by a growing legion of countries that favour trading in their own currencies.

Although the US downplays the threat exactly like the emperors in history did, when their respective empires were under threat, the world's only Superpower must have finally realized the futility of reading the riot act against the nations on regular basis.

The ground realities must have compelled the US policymakers think differently instead of catering to whims and fancies of political ideologies in a fast evolving world.

As far as oil and gas markets are concerned, the cooling political tensions involving the world's top two economies may create a conducive atmosphere to restore investor confidence that remains badly battered at present.

HA

----------------------------------------------------

If you want to see the data in explicit form, please click here.