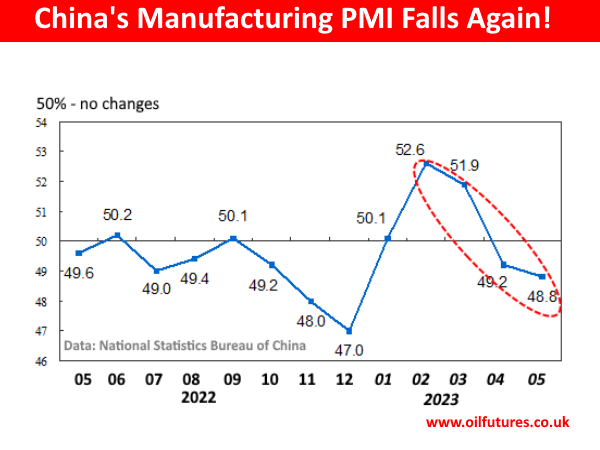

China's Manufacturing Purchasing Managers' Index, best known as the PMI, fell again in May, according to the latest data released by China's National Bureau of Statistics. This is is the fourth successive drop since February this year.

China says an index of the PMI below its threshold, 50%, is a downturn in its manufacturing activities. That means, the activities have been down for four successive months, despite recording a substantial growth at the beginning of the year.

In response, understandably, the price of crude oil dropped significantly in the commodity markets on Wednesday.

As of 10:45 GMT, the prices of WTI and Brent were $68.97 and $72.96 respectively. The price of LNG, liquified natural gas, was at $2.36.

The falling PMI means the manufacturing activities in the world's second largest economy remain a concern at many different economic levels.

The consumption of oil, for instance, may go down in proportion to the shrinking manufacturing activities. Perhaps the dwindling manufacturing activities may have stemmed from the cooling demand across the world that shows the prevailing headwinds in the global economy as a whole as well.

At present, China - along with India - are increasingly turning to cheap Russian oil in order to meet their respective domestic demands. As a result, the traditional Middle Eastern suppliers appear to be feeling the pinch at present.

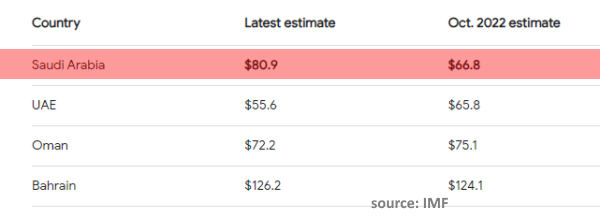

The recent outbursts by Prince Abdulaziz bin Salman, the Saudi oil minister, against the speculators, in this context, are fully understandable. Saudi Arabia cannot afford to let oil prices go substantially below the current level that could potentially pose serious challenges for its current mega projects aiming at a post-oil era.

The estimated break-even price for crude oil for Saudi Arabia in 2023 is $80.90 and with the current prices hovering well below it may be causing a palpable apprehension among the Saudi policymakers.

It shows the presence of black gold under your feet does not mean the extracting them to the surface is easy. The process costs the Kingdom much more than initial estimates; it, in fact, has ballooned substantially from that of 2022, in light of inflation, cost of materials and of course, labour.

In another development, Alexander Novak, the Russian deputy prime minister, took a diametrically opposite position recently when asked about the oil production cuts. He said that Russia would stick to the status quo, implying some strain in relationship between the two of the bigwigs of the OPEC+, Russia and Saudi Arabia.

The tone of Prince Abdulaziz in a recent discussion, meanwhile, clearly showed the frustration felt by the Kingdom due to falling oil prices. He literally warned the speculators against their practices, without spelling out the measures in the pipeline as a form of retaliation.

The ever expanding rift between China and the West is not in favour of either, though. If China suffers, the West will suffer too in the long run as the robust Chinese manufacturing is a key to the Western insatiable appetite for the cheap goods.

In short, there will be no winners - in the end.