The phone call between President Biden and President

Xi of China, after a lull of seven months since the first of that kind being

made, helped Asian markets make some gains in the early hours of trading. It is

felt in the crude oil markets as well.

Following the unexpected conversation, both sides

said it was ‘candid’.

Never in the recent history of the world, have the

two top world economies seen a growing mutual animosity between them, which

affects the global economy in many different ways; that’s why the thaw, no

matter how illusive it may be in the long run, has such a positive impact on

the markets worldwide that often are caught between in the tussle between two

economic superpowers.

The crude oil markets breathed a sigh of relief

yesterday too; the oil price made a strong recovery.

The reports of China’s recent tendency to tap its

oil reserves, in order to mitigate the impact on the domestic energy costs,

brought down the price of oil yesterday, having recorded a strong recovery from

earlier losses.

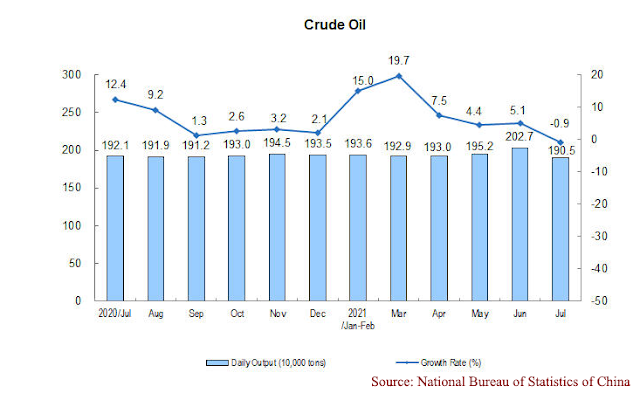

China’s National Statistics Bureau admitted recently

that the hike in the price of raw materials did affect its economic performance

in the second quarter. Although it did not identify the rising oil prices as

the main culprit, a catalogue of news reports indicates that the former is a

serious cause for concern for the Chinese.

Since China successfully controlled the latest

outbreaks of the Delta variant of the Coronavirus, analysts – as well as the

Chinese investors – expected a significant growth in demand for crude oil as

the transport sector and traffic slowly return to normalcy.

The rising energy costs, however, has hampered the anticipated

awakening. Since the appeals for rise in production, along with the other world

powers, do not appear to be bearing fruit, the Chinese have resorted to tapping

its reserves to manage the crisis to some extent – at the expense of its oil

imports, of course.

China is not the only country that embraced the new

trend of tapping the oil reserves. India has been in the news for doing the

same in the past few weeks and so has South Korea.

The OPEC+ producers are not immune to the impact of

these moves by the world’s top crude top importers: Saudi Arabia, for instance,

reduced its oil price for Asian on Sunday last week by more than $1.00 - a significant

move; Nigeria, one of India’s top sellers, meanwhile, according to Bloomberg,

has admitted that nearly 2/3 of its oil export for October was yet to find a

buyer; India’s imports from Nigeria, according to the report, has plummeted

from 20 million barrels to a mere trickle – just to 2 million barrels!

The OPEC+, meanwhile, is under pressure from the US

to increase the production – along with the rest of the major global buyers

too. Although the cartel has not heeded the call yet, it will not be able to

resist the move for long, because the security of some of the main Middle

Eastern buyers is inextricably linked to the US presence in the region and of

course, US military hardware.

Without the Patriotic Missile defence system, for

instance, Saudi Arabia’s very existence will be under threat. The Kingdom is

under attack on daily basis by the explosive-laden drones and missiles fired by

Houthis from the neighbouring Yemen.

The reality was publicly articulated by none other

than President Trump while in office, when his frustration grew over the

Kingdom’s inability to increase the output to curb the rising oil prices: “Saudi

Arabia will not last more than two weeks without the US military support,”

berated Mr Trump on one occasion!

Of course, the oil producers suffered very badly

when the price crashed during the pandemic. In this context, it makes sense

when they try to recover some of the earlier losses in order to survive in the

sector.

In addition, the oil producers in the Middle East

provide direct employment opportunities to millions of people from the poorer

parts of Asia, whose regular remittances provide the respective countries with

a lifeline to maintain their economies, most of which are badly hit by the

pandemic.

In this context, it is important to maintain s

sustainable crude oil price that saves both consumers and producers, as the mutual

survival of both is the need of the hour.