Oil prices did not fall precipitously as expected

due to the surge of Coronavirus infections in India and Japan, the world’s

third and fourth largest consumers respectively.

Of course, the situation in India is very grim in

terms of the exponential increase in the number of infections, relatively high

death rate and the logistical problems, when it comes to disposing of bodies;

the existing, centuries-old traditions and intricate taboos do not make the

challenge any easier either.

Japan, which is very keen on hosting the Olympics,

is in a similar situation; it, however, has resources at its disposal to

mitigate the severity of many challenges.

In this context, it goes without saying that the

demand of crude oil from both countries is going to go down in the coming weeks

and in anticipation, the crude oil futures will suffer to some extent.

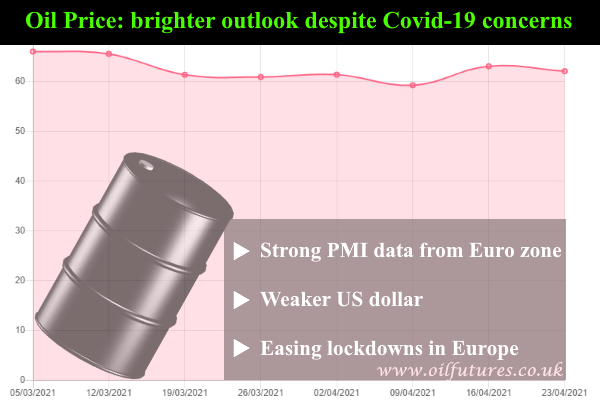

This week, however, the oil price did not fall as

much has the traders feared. On the contrary, it got back to the ‘green zone’,

having been through a relatively short period of volatility.

Oil analysts believe that the strong economic data

from Euro zone is a key factor that is behind the rise in price, even if it is

small: Purchasing Managers’ Index (PMI) of the Euro zone showed an economic

recovery stronger than what was predicted.

In addition, the value of the US dollar in recent

weeks has weakened, which in turn increased the buying power of crude oil

importers.

In Europe, meanwhile, the fear of the Third Wave is

gradually subsiding: France, for instance, is planning to reopen schools next

week and international air travel in May. The other countries in the Western Europe,

judging by the collective optimism across the region, will follow suit in the

coming weeks.

During the past few weeks, the pandemic situation in

Europe had been worrying investors and traders alike. In light of easing

restrictions related to lockdowns in Europe, in a coordinated manner, the positive

sentiment in the markets has been buoyant as well.

The US economic data is very encouraging too; the

weekly jobless numbers have gone down, reflecting the strength of the US

economy.

All in all, there is no reason for the recovery of

oil price to lose its momentum at present.