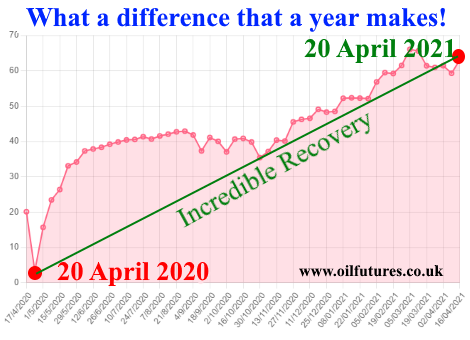

It has been a year since textbooks on fossil fuels

were revised, adding an indelible bookmark to the contents that span decades;

the crude oil price crashed on April 20, 2021 with price going to negative for

the first time ever – something that has never happened in the history of oil

trading.

Nor was it predicted by any analyst, even in the

worst case scenario.

It was, quite rightly, branded, the Great Oil Crash.

Not only did the oil price recover quickly from the

disaster, but also steadily increased while defying a catalogue of

uncertainties, ranging from resurgence of Covid-19 infections to political tension

in the Middle East that sometimes bordered on military conflicts.

This week, the price picked up again amidst the

weaker US dollar. In addition, the markets are in a buoyant mood due to the

rise in China’s petroleum imports and the fall of US crude oil stocks.

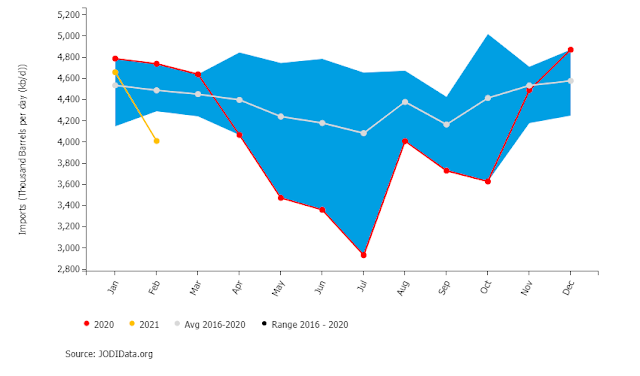

The news that comes from the world’s first two

consumers of the crude oil clearly shows that recovery of demand is now irreversible;

it is inconceivable to see a repeat of ‘April 20, 2020’, the Great Oil Crash.

The Coronavirus situation in India, the world’s

third largest consumer, however, is still a major concern; there are over

300,000 infections just on Tuesday with a significant death rate: there are

concerns about the supply of oxygen to hospitals across this vast country; hospitals

are running out of beds; crematoriums are full. It’s a very serious situation,

indeed.

The impact on the Indian economy that saw the worst

crash for 70 years is unimaginable; it’s no wonder why the crude oil imports

are falling in India.

In these circumstances, the optimistic sentiments in

the world’s top two consumers of crude oil so far managed to eclipse the Indian

factor.

There are clear signs that the developments will

stay that way for the next few weeks, unless the situation in India takes a

turn for the worse.