|

| US Shale Boom |

The US shale boom has regained its lost momentum in the immediate aftermath of Covid-10 pandemic.

According to the latest data, both Exxon Mobil and Chevron have reported strong financial results that has directly stemmed from the increased production; the production activities have increased in the Permian Basin in Texas, US.

The shale oil industry was dealt a massive blow in 2020, when the oil price - and the demand - crashed in the wake of once-in-a-century pandemic.

The industry had been facing with its own challenges even before the pandemic broke out, due to higher production costs relative to those of the conventional oil producers.

They were compelled to compensate for the high production costs by increasing the price of shale oil; the OPEC+, meanwhile, made the very survival of the sector even harder by artificially deflating the oil prices by increasing the production.

During the booming years, meanwhile, the industry accumulated significant debt in order to fund the new technologies and drilling projects. The price crash in 2020 made it difficult for them to pay off loans, let alone attract more investments; hence uncertainty loomed over the entire industry; investors became reluctant to throw their money for new projects as the future seemed bleak.

In the past three years, however, the technologies have improved with new innovations. The industry managed to increase the production to a level with an output around 9 million bpd - barrels per day; it is still below the values at the peak - 11 million bpd - in its heyday that in turn catapulted the United States to the position of the world's top oil producer - and by extension, a net exporter.

Chart and Data: credit - Statista

Not only did the shale boom bring down the energy prices, but also led to a growth in the economy in the shale oil producing regions, it increased the job opportunities in many sectors too.

Shale oil and gas are extracted from underground rock formations by a process called, fracking or hydraulic fracturing.

The main challenge faced by the drillers, when it comes to extracting oil and gas by fracking, as far as the environmental impact was concerned, was to stop the ground water from being contaminated during the process.

There are significant number of people, both in the US and Europe who oppose fracking, because they think it can even trigger mini-earthquakes due to drilling activities deep down the Earth's crest.

As for the ground water, fracking is usually taking place far below the ground water levels. The critics, however, still see the dangers.

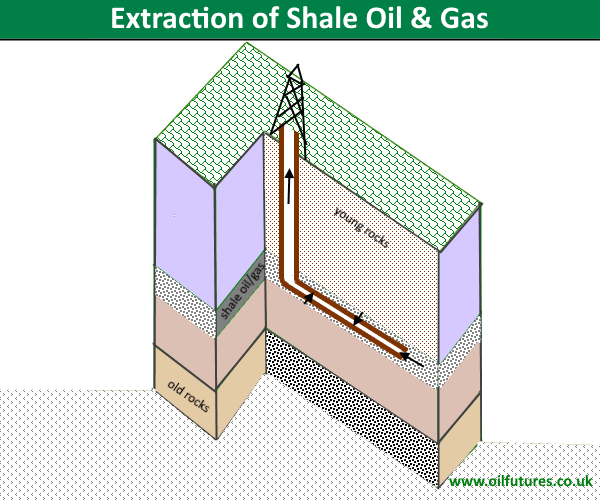

In Fracking, the drilling takes place in two forms: vertical and horizontal drilling.

|

| Fracking: shale oil an gas extraction |

The vertical drilling is carried out for miles underground up until the target rock formation is reached. The horizontal drilling is then carried out within the rock formations for thousands of meters to extract gas and oil by a complicated process, known as perforation.

Steel drill pipes are inserted into those bore holes, both vertical and horizontal, while filling the gap between former and the ground soil with cement, whereby the casting can keep the contamination of ground water at bay.

Once the systems are in place in the rock formations, shale oil and gas can be extracted for up to 40 years, according to the shale oil producers.

Of course, the booming shale oil sector is going to cause worries in the conventional oil sector in the coming months, OPEC+ in particular, especially at a time when the production cuts failed to shore up the prices; in short, when the shale industry extracts shale oil from the rock formations, the ripples in the industry push the OPEC+ to a place between the rock and the hard place in such a way that the latter finds a very little room for manoeuvre.

Analysts, in this context, attribute the sudden decision by Saudi Aramco, the world's largest oil company, a few days ago to halt the expansion of multi-billion-dollar expansion of oil facility, to the evolving realities on many fronts, including the shale boom in the US, something that the Middle Eastern producers may not have assumed to recover relatively fast.