|

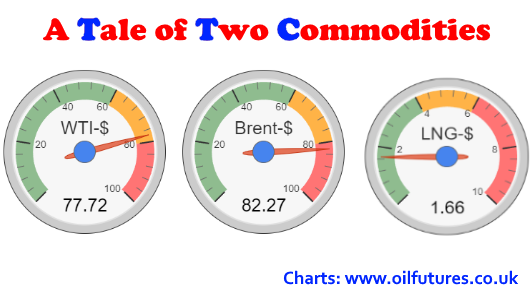

| Prices of LNG and Oil on16 Feb 2024 |

As the feared 'R' word started doing rounds yesterday with Britain falling into recession, the energy markets have gone into shock-absorbing mode for obvious reasons; it goes without saying that the low manufacturing activity that inevitably stems from shrinking economic growth means less consumption in the main commodities such as oil and gas.

Even before the official announcement by the British authorities about the country being in recession, the price of LNG, liquified natural gas, has been falling during the last two weeks.

The United Kingdom was officially declared being in recession in line with the text book definition of the latter: there were two successive negative growths in the GDP during the third and fourth quarters in 2023 respectively.

As of 14:00 GMT, the price of LNG was at $1.61, whereas the same was $2.35, a year ago. The price of oil, however, has slightly gone up in the past few days, despite the falling US crude oil stocks. As of 14:00 GMT, the prices of WTI and Brent, the two main benchmarks, were at $77.69 and $82.26 respectively.

The fact that Britain fell into recession grabbed headlines at a difficult time for the ruling Conservative Party, because there were two by-elections held on the same day; by coincidence, the Tories lost both seats to the opposition, Labour Party; the impact on the outcome by the disappointing economic news remains to be gauged by the political analysts.

The officials blamed the recession on less spending by the British public; the spending during the Christmas, for instance, according to officials, is much less than what they anticipated.

It is clear that the inflation is partly to blame for the trend that is inextricably linked to the high energy prices.

The GDP growth in the Eurozone is not encouraging either; nor is that of Japan - all being the victims of high inflation.

Although oil and gas prices have fallen recently, the drop in prices has not translated to price drop at pumps in exact proportion yet; neither has the falling gas prices.

The falling commodity prices are certainly good news for beleaguered customers. They, however, push the producers of the commodities into a state of uncertainty, when it comes to attracting investments; moreover, the coffers of the countries in question are going to feel the pinch, if the downward trend continues.

Qatar, the world's largest exporter of LNG, for instance, will find it difficult to absorb shocks, as 70% of its revenues are from the sale of LNG; that means, both budgetary allocations and development plans will suffer in light of the developments in the sector.

The North Field project, for instance, that could potentially secure Qatar' s position as the world's leading LNG exporter may be in the unchartered waters, if the price of LNG keeps falling further in the international markets.

Since the countries in the northern hemisphere are coming out of the cold winter season, there is no catalyst in the offing that could push the price of gas up, unless the price of oil goes up unexpectedly.

The crises in the Middle East and Ukraine have already lost its spark in firing up emotions of the cautions investors: an escalation of regional war seems to be unlikely despite the provocations by many actors in the Middle East; neither Iran nor Hezbollah of Lebanon appears to be in favour of an escalation.

In yet another blow to the crude oil markets, the EIA, US Energy Information Administration, reported a significant build in the US crude oil stocks, implying the presence of enough barrels in the markets.

.png)