|

| Japanese economy - feeling the pinch of rising energy costs |

As the war between Israel and Hamas enters its second week, with no sign of the hostilities being on the wane, Japan, appealed to the oil producing countries on Wednesday to increase the production in order to stabilize the energy markets.

The urgent request was made after a telephone conversation between Mr Fumio Kishida, the Japanese prime minister and Mohammad bin Salman, the Saudi Crown Prince, over the war in the Middle East and its impact on the civilians in the affected areas.

Both leaders have discussed the ways to ease the tension in order to minimize the suffering of those who have been caught in the crossfire.

It is not clear whether Mr Kishida personally brought up issue of the rising oil prices with the de-facto Saudi leader.

On Thursday, however, Hirokazu Matsuno, the chief cabinet secretary, spelled out the Japanese position on the same issue: “Government of Japan will urge oil-producing countries to stabilize the global crude oil market by increasing production and investing in production capacity,” said he to the reporters, reflecting the anxieties of Japan, the world's fourth-largest importer of crude oil, on the impact on the economy.

It is interesting to note that Japan, a member of the IEA, International Energy Agency, wants to increase the investment in the production capacity too something that the latter as an organization takes a different view due to its commitments to the renewables.

source: tradingeconomics.com

Japan that usually imports 2.7 million barrels a day on average, relies on the Middle-Eastern suppliers for 90% of its oil. In this context, it is clear the intended audience of this particular appeal at a very uncertain time for the global economy as a whole.

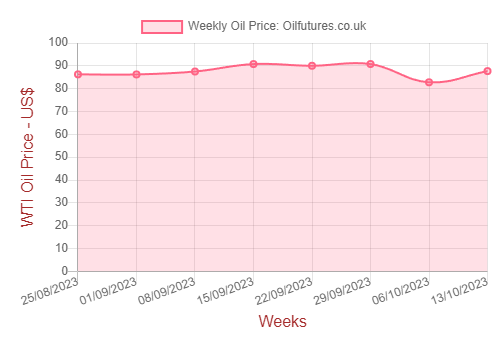

With no sign of the war between Hamas and Israel abating, Japan - and the rest of the developed world for that matter - are worried the impact on the global energy prices. The price of crude oil has gone up by $5 since the start of the war.

Although Iran wants the OPEC+ to stop exporting oil to Israel, the arch foe of the former, the cartel does not appear to be heeding the member's call. The situation in the Middle East, however, is highly volatile and could get worse before getting better with more actors in the region being sucked into the conflict.

The presence of formidable US striking groups, however, could keep the threat of a wider conflict at bay - to some extent. At least, it could guarantee the smooth flow of crude oil across the Strait of Hormuz due to its commanding position.

As of 10:30 on Thursday, the prices of WTI, Brent and LNG, liquified natural gas, were at $87.01, $89.87 and $3.05 respectively.

With the rise of oil prices, the governments of non-oil producing countries have been forced to take the urgent measures to control the inflation. In the West, although it subsided a bit in the past, is again on the rise in proportion to the rising energy costs.

With the winter season in the offing, the price of natural gas usually goes up. The conflict in Ukraine and the major crisis in the Middle East can only exacerbate the anxieties in the commodity markets.

Analysts, meanwhile, are watching the response of Qatar, the word's leading exporter of LNG that used to pay the salaries of the government servants of in Hamas-controlled Gaza strip on humanitarian grounds.

In addition, the US is planning to add more sanctions against Iran, focusing more on its main export - crude oil. Iran is still under sanctions and its oil, however, still finds a way to the global markets through various channels despite the obstacles.

Once in the pool, it is not easy to make out the origin of oil and producers that are under sanctions use the simple chemical fact to get away with sanctions.

Since the members of the West cannot release oil from their respective SPR - Strategic Petroleum Reserve - anymore, especially at a time of a serious war threat, the entire world is back at the mercy of the Middle Eastern producers for the availability of this vital commodity.

A boom in renewables has not taken the existing threat off the supply side of the energy equation at all; far from it, when the reality kicks in.