|

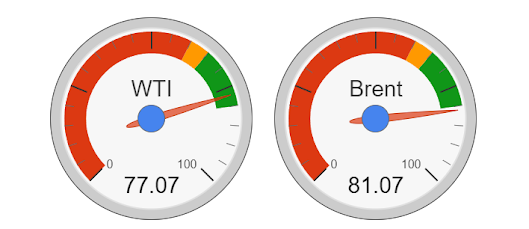

| WTI and Brent Price on 21 July 2023 |

The price of Brent crude oil went up above the market-sensitive threshold, $80 a barrel on Friday, having fluctuated just below the value during the week.

As of 18:00 GMT, the prices of WTI and Brent were $77.07 and $81.07 respectively. The price of LNG, liquified natural gas, meanwhile was at $2.71.

Initially, the production cuts announced by Saudi Arabia and Russia that amount to 1.5 million bpd - barrel per day - that is about 1.5% of the global production appeared to be the cause for rise in prices, purely on sentimental grounds.

|

| WTI price fluctuation on weekly basis |

There is, however, more to it than meets the eye.

The Russian factor that dominated the crude oil supply for the past year, for instance, does not seem to be favorable to those who used to cash in on deep discounts any more.

On one hand, there is a price cap of $60 imposed by the West on Russian oil; on the other hand, there is a serious issue involving payments, as the buyers cannot pay in US$. In addition, the diminishing discounts do not create a buyer-frenzy atmosphere anymore.

Indian refiners, for instance, were recently compelled to pay in Chinese yuan for the Russian companies, despite the strained relations between China and India. According to the Indian media, the payment issue has reached a critical junction, a pragmatic deviation from the impasse appears to be easier said than done.

Based on tanker data, some analysts even say that the Indian appetite for Russian oil has already peaked, having reached record high in June, 2023. This is something that remains to be seen, though.

India hardly bought Russian oil before the invasion of Ukraine by Russia in February, 2022, because of high freight costs. Indian suppliers, for this reason, had been from the Middle East, mainly Iraq and Saudi Arabia.

As the refiners turned towards Russia, having been wooed by heavy discounts, the traditional suppliers were forced to occupy the second and third rank along the supply chain, with Russia being at the top. China, the world's second largest consumer of oil, followed the same path.

The tendency dealt a serious blow to Iraq and Saudi Arabia in particular and the OPEC+ in general - with the fall of oil price as a consequence.

The combination of production cuts by Russia and Saudi Arabia and shrinking Russian discounts may push the price of Russian oil above $60 a barrel and Russian exports, then, are going to hit a serious roadblock, because the buyers would not be able to pay by legitimate means above that price.

Thanks to discounts - and fall in prices - India, the world's third biggest consumer of oil, managed to bring down its bill for oil and gas imports by a third from that of a year earlier; the volume of oil imports, however, has fallen by approximately 1% during the first quarter this year, compared with that of the last year during the same period.

Having sensed an unexpected opportunity in the energy markets, Iraq is trying again to woo the Indian refiners by offering greater discounts and extending the credit period from 60 days to 90 days, leaving an influential OPEC+ member, Russia, in an oily lurch while securing its foothold.

As things stands at present, as far as the Indian oil imports are concerned, Russia is at the top of the pecking order and Iraq, Saudi Arabia, the US, and the UAE hold their corresponding positions fairly firmly, with the discounts being the only catalyst that can bring about a change in the status quo.

|

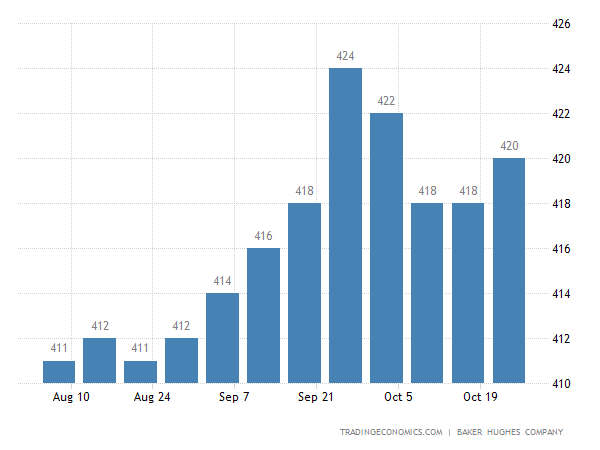

| Oil rig count in the US |

As far as the word's second largest consumer, China, is concerned, analysts are in the opinion that the economic activities leave much to be desired: the frosty relations between the US, the world's largest economy show no sign of improvement and they take their toll on many tentacles of trade; even the recent visit by one of China's old friends, Henry Kissinger - the centenarian and former, seasoned top US diplomat - does not seem to have broken ice.

This means, although China is still buying Russian on a mass scale thanks to deep discounts, the trend does not reflect either an economic revival or a consistent buying spree of the commodity in the long run. Investors, in this context, are much more cautious in pinning their hopes on the Chinese influence in the oil markets.

Last but not least, the anxiety over the recession in the US in the next two quarters and the 'mild' recession in Europe are casting a long shadow across the markets, in addition to the other political chaos across the world. The oil producers, in light of these factors, may find a weak sense of optimism to celebrate the new-found gains in the oil price, knowing very well that there is little room for complacency.