The price of crude oil went down more than 10% this week, perhaps due to the fears over recessions that could sweep over the top global economies in the coming months, if confirmed by the forthcoming GDP figures for the Q2, the second quarter.

Since two successive quarterly contractions spell the much-dreaded word, recession, crude oil markets appeared to have exercised caution, emulating other major markets.

In addition, the threats by the Biden administration against major oil companies over hefty profits at the expense of the impact on the economy and his planned visit to Saudi Arabia in July may have

played some role in the anxieties that prevail in the markets at present.

With the cost of living on a steady upward march, the Western governments failed to inhibit the trend by adopting a catalogue of measures, ranging from duty cuts on fuels to offering subsidies to beleaguered households - all to no avail.

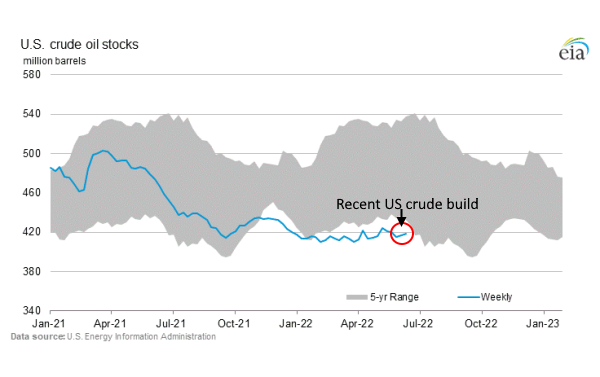

Although the fluctuations of the US crude stocks that usually used to reliably indicate the trend in oil prices in the past, in recent times, they did not form a reliable indicator; the estimation of daily oil price - or even on weekly basis - has been a very complex form of 'science' that did not just swing on the fulcrum of data science, amplified by the draughts of expert opinions.

For instance, in the recent past, despite the crude builds - sometimes, very substantial - the price of crude oil started rising as if the former neither existed nor mattered that much, leaving a trail of inverse trends of what were anticipated.

In this week, however, there was an exception: there was a modest crude build, confirmed both by the EIA, US Energy Information Administration, and API, American Petroleum Institute. In this context, some analysts attribute the substantial fall in oil price during this week to the crude build, although it is debatable.

Crude oil price is not the only commodity that showed a significant drop in price this week; LNG, liquified natural gas, also recorded a drop of over 30%, having reached record high in June.

It is strange that despite obvious supply constraints in the commodity sector, exacerbated by the ongoing war between Russia and Ukraine, the price of crude oil and LNG fell sharply; analysts believe the impact on major economies by the energy costs is much more serious than initially feared.

The frequency and the scale of rate hikes just reflect the apprehension in the corridors of Western powers that can drift towards the emerging markets as well in the long run.

All in all, analysts are keen to watch the movements in the energy markets on Monday, when they are open for business, in order to see whether spectre of this week is just an exception, triggered off by disproportionate negative sentiments.