No sooner had the West and its staunch allies imposed crippling sanctions against Russia over its invasion of Ukraine than the latter published a list of 'unfriendly' countries.

They include the European Union, the UK, Japan, South Korea, Switzerland, Singapore and of course, the US.

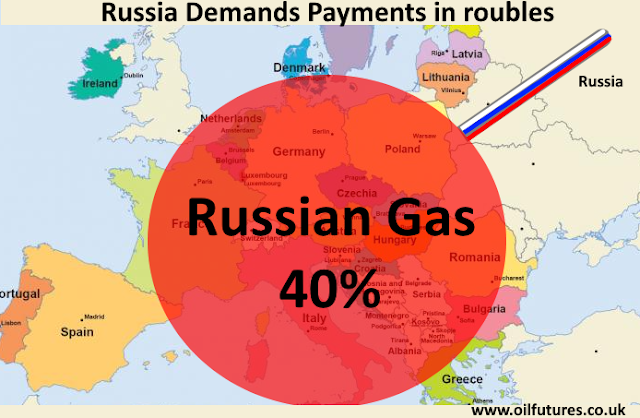

Having endured the impact of the sanctions for a few weeks, Russia seems to have decided to hit back without resorting to the worst case scenario that the most Europeans feared in retaliation - completely cutting off the gas supply to the European states.

Although European winter is now over, such a move a few weeks ago would have been disastrous for the Europeans, as the tail end of the winter is always very cold in the region.

Instead of going for the much dreaded 'nuclear option', Russia seems to be determined to adopt a 'milder' form of retaliation; it wants the unfriendly nations to pay for gas in its national currency, roubles - not in euros or US dollars; Russia says it will still meet the contractual obligations.

The move by Russia, however, is not well received in Europe. Germany and Italy, two major buyers of Russian gas, for instance, have already voiced their opposition to paying in roubles, saying it is tantamount to a breach of contract; they want to consult the European partners in order to come up with a collective response.

That means the legal wrangling over the issue will continue for some time unless both sides reach a compromise; it is neither going to be easy nor quick, especially both sides in the dispute are poles apart on every major political issue - at present.

The fuel markets immediately sensed the prolonged uncertainty for months to come and the price of LNG rocketed after the news broke out; it went up by almost 30%.

Understandably, rouble, the Russian currency strengthened over the news; it went up by 7%, reversing its precipitous fall after the invasion of Ukraine.

The list of hostile countries in Russia's list view the development as a strategic move by the former to prop up its own currency.

They, however, have very little room for manoeuvre, when the fuel prices have reached record heights at the pumps that in turn push the inflation up; in the United Kingdom, the very figure has already reached 30-year high.

The Russian supply of gas to Europe is said to be 40%, a staggering figure that in turn guarantees Russia revenues over $800 million a day!

Moreover, finding substitutes for gas imports is easier said than done - and in a rush, of course. Qatar, the world's largest LNG exporter up until recently, said it clearly even before the invasion, it cannot be a substitute for Russian supply.

The developments in the crude oil markets are not encouraging either: as of 10:30 GMT, the prices of WTI, Brent and LNG were at $114.68, $121.93 and $5.19 respectively.

As the Middle Easter suppliers are not willing to increase the production, there is no solution in the offing for the rising oil prices; despite the cut in fuel duty by 5p in the United Kingdom, the desired effect has not materialised yet.

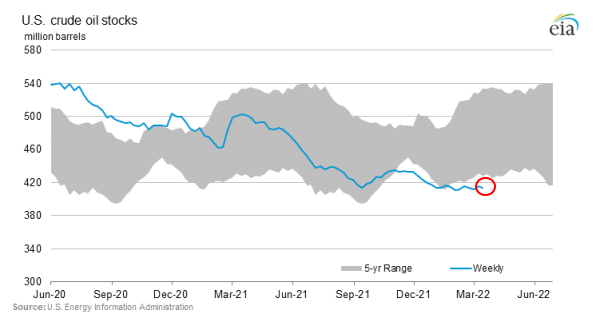

In a surprising development, meanwhile, the US crude inventories have fallen last week despite the rising oil prices; both the API, American Petroleum Institute and the EIA, US Energy Information Administration, have released data that supports the inexplicable trend.

As the financial tug-of-war continues between the West and Russia, economists now warn about a global recession unless energy markets stabilize soon; they say it is not easy to sustain the economic growth when fuel prices skyrocket at this rate.

The post-invasion developments have pushed the Western policy makers to a corner, indeed. On one hand, they want to send Russia a strong message that what is happening in Ukraine is not acceptable; on the other hand, they are acutely aware of the impact on the lives of people as the economic costs start to bite.

Having been sandwiched between two unpalatable scenarios, glued by the moral equivalent of an equally unpalatable sauce, they certainly are stuck between the rock and hard place.