Despite the looming threat of war between India and Pakistan, which carries the risk of significant disruption to oil and gas tanker traffic and the need for expensive alternative shipping routes, energy prices have surprisingly not risen. In fact, after remaining stable in the initial part of the week, both oil benchmarks experienced a sharp decline in the latter days.

As of 16:40 GMT on Friday, West Texas Intermediate (WTI) crude oil was trading at $58.29 per barrel, while Brent crude stood at $61.45 per barrel. Bucking the trend, the price of liquefied natural gas (LNG) edged slightly higher, a counterintuitive move given the onset of warmer weather in the Northern Hemisphere as summer approaches.

According to the IMF, Saudi Arabia requires a crude oil price of at least $90.12 per barrel to break even. With Brent crude currently trading nearly $30 below this threshold, maintaining sales at present prices would necessitate substantial savings in other sectors to balance the budget. This could potentially lead to delays or postponement of ambitious projects like The Line, until oil prices recover to the desired level.

Amidst speculation of disagreements within OPEC+ regarding production quotas, the cartel has moved its virtual meeting, initially scheduled for May 5th, forward by two days; it is going to take place today. Iraq and Kazakhstan have been specifically identified for exceeding their agreed-upon production limits.

During Saturday's meeting, the members will need to execute a delicate balancing act. They must consider the anxieties of members significantly affected by plummeting oil prices. Simultaneously, they must avoid production cuts solely to inflate prices, a move that could result in a loss of market share, as non-OPEC nations like the United Kingdom and Guyana could seize the opportunity presented by supply shortages.

Adding a significant layer of complexity, China, the world's leading oil importer, has witnessed a substantial decline in its manufacturing output, likely stemming from the ongoing tariff dispute with the United States.

China's Manufacturing PMI, a reliable indicator of manufacturing activity in the world's second-largest economy, dropped from 50.5% in March to 49% in April, falling below the 50% threshold that separates growth from contraction.

Oil producers as well as investors in the sector have been pinning their hopes on the performance of the Chinese economy for the revival of crude oil prices. They may have sensed that China was not doing well while being engaged in tit-for-tat tariff war with the United States.

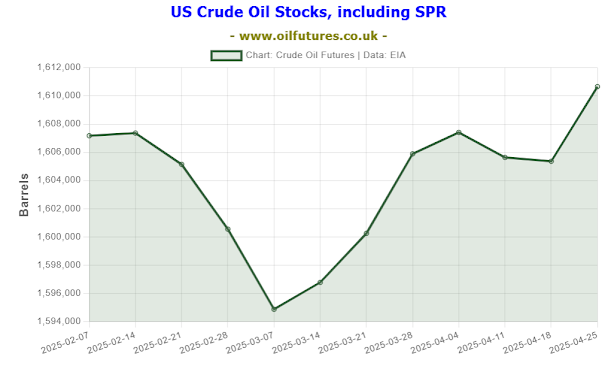

Compounding the issue, rising US crude oil inventories signal weakening demand. As the world's largest consumer of fossil fuels, a decline in US demand invariably has widespread consequences throughout the global energy sector.

Recent data from the EIA (US Energy Information Administration) shows that US crude stocks have been increasing since the onset of the tariff war in April, suggesting that American consumers are becoming more cautious about transportation spending.