|

| China's Manufacturing PMI - March |

With China's manufacturing sector returning to the expansion territory in March, recording the highest manufacturing PMI since September, 2023, the economic outlook of the world's second largest economy depicts a positive picture - at last.

The announcement on Sunday by China's National Statistics Bureau on the PMI, was further boosted by the fact that the country's logistic industry showed even better improvement in March; the data released on Tuesday shows that the logistics industry prosperity index rose by 4.4 points to 51.5.

That means, Chinese economy shows the signs of recovery while moving past the weathered milestone of stagnation that silently witnessed the interplay of a range of complex factors, some clearly stemming from evolving geopolitical axis, in a relatively short passage of time.

The positive indicators in the recent days from China appear to be showing its catalytic effect on the crude oil markets; the price of both WTI and Brent rose after the Easter break.

As of Wednesday at 11:00 GMT, the price of WTI and Brent were at $85.47 and $89.30 respectively.

|

| WTI and Brent prices | www.oilfutures.co.uk |

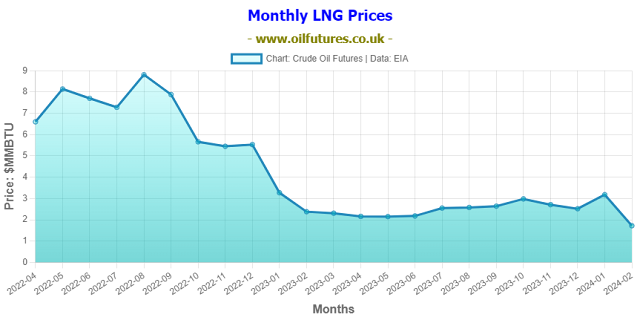

The price rally, however, is facing some headwinds. The combination of record low prices of LNG, liquified natural gas, the end of winter season in the northern hemisphere and of course, large gas reserves in Europe and America has clearly become a drag on the recovery of oil prices.

After becoming the top exporter of LNG last year, the US has clearly elbowed the traditional players in the sector such as Qatar, Russia and Australia to claim the crown: by tapping on vast reserves of shale gas trapped in the rock formations by horizontal drilling, coupled with the advent of new technologies, the new-found dominance of the US in LNG sector will remain unchallenged for years to come.