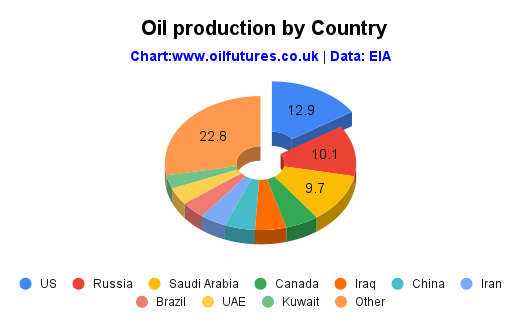

The latest data from the EIA, US Energy Information Administration, suggests that the US had been the largest producer of crude oil in 2023, despite turning to other sources to boost the global oil production.

It has been more than 4 years since the US became a net exporter of crude oil. The data explicitly shows that the US retains the crown for the largest production, while pushing both Russia and Saudi Arabia down to the second and third place respectively.

As of December 2023, the US accounted for 12.9% of the global oil production. The same figures for Russia and Saudi Arabia were 10.1% and 9.7% respectively.

The contribution from the UAE, a close ally of the Kingdom, was just 3.4%. In this context, the reported reluctance of lowering the quota in line with the more powerful members of the OPEC+ by the UAE is perfectly understandable, as it means losing a big chunk of its vital revenue stream.

It is interesting to note the contribution by Iran to the global oil supply: it stood at mere 3.4% despite the noise about sanction busting moves in the media; it looks like that the years of sanctions at many different levels have hampered process of modernizing the aging infrastructure that in turn resulted in relatively low oil output.

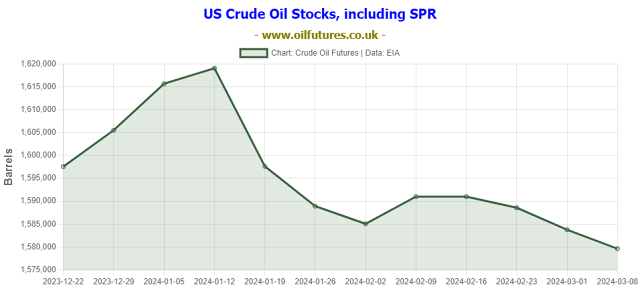

The news about the US becoming the top producer comes amidst concerns that the US has not met the target of filling its SPR, Strategic Petroleum Reserve, as planned, despite the falling oil prices.

The US started releasing oil from its SPR in order to make the global oil prices stable, when the OPEC+ chose to curtail the production in order to do the exact opposite. In the end, the US strategy seems to have worked as the price of oil did not skyrocket as some investment bankers prophesized.

With SPR, which is meant to to tapped into only in an emergency such as an outbreak of war, at a record low level, the Biden administration is not short of critics, who see the status quo being very risky, although there is no possibility of the US going to war with another country at present.

According to the predictions by analysts, the US may fill about 10% of what has been released in order to address the issue of global availability of crude oil. The real figure, however, is estimated to be just 4%. The US has released 291 million barrels from its SPR during a period of 30 months since the administration came to power, leaving the vital reserve at the lowest level since 1983.

With the presidential election just 8 months away, and the rival making the energy - or lack of it - one of the key issues to rally his troops around, the Biden administration cannot afford to get the numbers or strategy wrong in the coming months.

In short, it has to walk a tight rope: on one hand, the climate lobby that was instrumental in bringing Mr. Biden to power cannot be made upset by going back on the pledge - not to issue new licenses for the oil exploration on Federal lands; on the other hand, President Biden cannot afford to let the consumers in the US suffer at the pumps, when they fill up their tanks; in order to address both issues, a well-rehearsed balancing act must be performed, something that is easier said than done.

The US crude stocks, meanwhile, have gone down for two successive weeks that led to the slight hike in oil prices. Both the API, American Petroleum Institute, and the EIA released data to that effect.

If oil prices keep rising on account of this significant factor, the US may be compelled to supply the crude oil markets with more oil, especially in the election year; how the US is going to address the issue remains to be seen, though.

The remaining options for the Biden administration are very limited, though: the OPEC+ will not reverse production cuts - a fact; on the contrary, they are going to extend the period of cuts further; there is no possibility of reaching an agreement with Iran over the JCPOA, 2015 Iran nuclear deal, so that Iran will be able to make a comeback to the oil markets as a legitimate player; President Maduro of Venezuela is about to announce a presidential election with the former being the sole candidate, making mockery of sanctions waiver for the Latin American country on the promise to holding free and fair elections.

If the oil prices keep rising in the coming months on account of the rising demand - judging by the recent crude stock draws - it will be a major political issue for the incumbent at the White House, in addition to a few other major issues to be addressed.

His rival, President Trump, has made it clear about his position when it comes to the US energy policy - 'Drill baby drill'. While referring to what he calls, 'the black gold under American's own feet', President Trump want to tap into the vast US reserves as never before to bring down the oil prices.

Since the possibility of President Biden doing a full 'U' turn on cutting down on green house gases is very low, he will be compelled to give diplomacy yet another chance in order to find ways to boost the global oil production. It will be a tough nut to crack, though.