|

| Oil and gas prices - January, 2024 |

As the energy markets attempt to limping back to normal after a long period of holidays, the prices of commodity did not show any sign of revival. On the contrary, the prices of WTI, Brent and LNG, liquified natural gas, recorded losses by 3.4%, 2.99% and 0.075% respectively in the first week of the New Year.

Despite the plummeting temperatures in Europe and America, the price of natural gas did not spike as anticipated during this week either.

As the Europeans took timely precautions against harsh winter months, the fear of gas shortages has just disappeared into the thin air. Germany, for instance, managed to fill its reserves to an unprecedented 91%, according to media reports.

Analysts believe that the downward pressure on the commodities come in the form of weakening global demand, increased US crude stocks, warmer-than-expected winter during the last three months in 2023 and of course, the tightening sanctions against Russian oil and gas by the European Union that in turn resulted in downward pressure being put on the crude oil price.

The latest forecast by the EIA - US Energy Information Administration - clearly sums up the worst fears of the beleaguered traders, anxious investors and of course, producers. It says that the prices will remain static for the next two years!

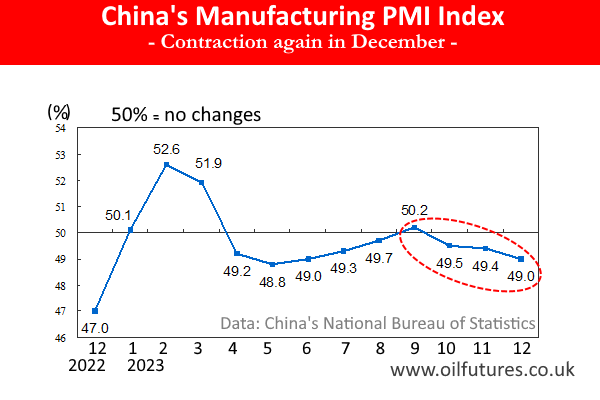

The unexpected China's manufacturing contraction weighs down on the price of oil as well. China's Manufacturing PMI has been below the threshold since October last year, according to Chin's National Bureau of Statistics.

|

| Chinese Manufacturing PMI |

Since China is the world's biggest importer of crude oil, its falling demand has led to a surplus of crude oil in the markets. China could not shore up its manufacturing output despite the festive season in December, when the demand should have skyrocketed for Chinese made goods. It, however, has not happened with the continuation of the contraction.

Although some factors that could potentially push the oil prices up have been still at play, the lower demand dampened the optimism of the traders and investors.

The ongoing conflict in the Middle East and North Africa, for instance, was a perfect recipe for a steep increase in oil price; as the initial pandemonium, died down, the energy prices found the equilibrium quickly, defying the pundits in the sector.

Even a relatively weaker US dollar could not excite the buyers despite oil and gas prices, most of the time, if not all, being denominated in dollars that in turn make it attractive to the buyers holding other currencies.

In a surprise move, meanwhile, Saudi Arabia has cut the price of oil for all its customers, extending the New Year gesture beyond Asia.

Saudis may have taken into account the new global realities while making the move: the oil production in the US has increased significantly along with Venezuela making a comeback to the markets; Angola's departure from the OPEC+ over its quota means it is in a position to determine the price in line with its own national interests, without being dictated by the more dominant players of the cartel.

All in all, there are no signs of oil price hitting unsustainably higher values anytime soon. The over-the-top predictions of hitting it above $100 in the near future just stem from wishful thinking without an iota of evidence to justify it.