|

| Diesel Usage in India |

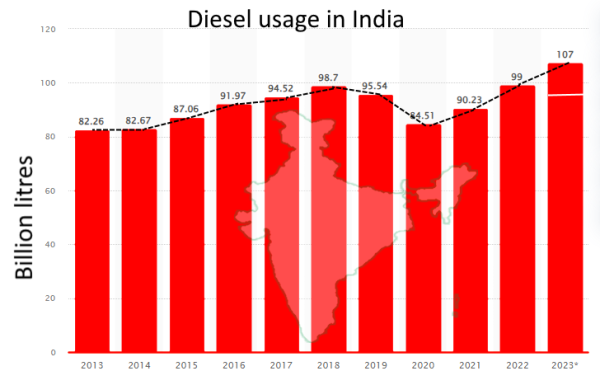

The sale of diesel in India, the world's third largest consumer of fossil fuel, has unexpectedly fallen in September, according to the latest data.

The fall in sale of the commodity for the second successive month has been attributed to the low demand and heavy rains during the monsoon period by the Indian authorities.

It, however, coincides with the thinly veiled warning by Nitin Gadkari, the union minister for roads and transport of levying an additional 10% tax on the sale of diesel vehicles. Mr Gadkari wants to clamp down on the billowing black smoke formed by vehicles on the roads in India that is known to be a highly polluted country.

He further said that in addition to taxes levied on the sale of diesel vehicles, he might impose taxes on diesel too in order to address the growing menace of air pollution.

The threat of levying multiple taxes resulted in the fall of value in the stocks in the auto industry as well as those of oil and gas sector, despite the intended move not being imminent.

Indians appeared to have sensed that the move was in the offing: passenger vehicles powered by petrol, for instance, have gone from 42.5% in 2014 to 64.8% in 2023, according to Indian media.

Despite good intentions behind minister's move, taking the diesel-powered vehicles off the gigantic road network is easier said than done; since almost all the taxis and trucks are powered by diesel at present, any move to taking them off the roads in a rush could result in a socio-economic disaster.

The evolving development in the fuel sector in India comes at a time when the global oil prices are on the rise, prompted by the production cuts - announced and then extended - by Russia and Saudi Arabia.

Saudi Arabia, meanwhile, has maintained its sale volume of fuels to Asia without a change, but increased the price slightly. In light of falling sale of diesel in India and the move by the government to levy multiple taxes on the commodity, however, the oil producers will be compelled to change their strategy rather than cutting down on production on impulse.

In the commodity markets, as of Friday this week, the price of WTI and Brent were at $90.77 and $93.93 respectively. The rise in oil prices has stoked fears of inflation among investors - and consumers - that had dealt a huge blow to global economy just after the Covid-19 pandemic.

Rising fuel prices have left the central bankers in yet another uncomfortable lurch, ripping apart their shell of complacency. The ECB, European Central Bank, for instance, raised its interest rates by 25 basis points on the grounds of taming the inflation; this is the 10th consecutive rate rise in recent times.

The ECB admitted that the inflation is still stubbornly high, while justifying its latest move, despite that being detrimental to the growth in the bloc.

The rise in oil prices at pumps, meanwhile, has left the Biden administration in a very difficult position: it is not in a position to release crude stocks from the SPR, Strategic Petroleum Reserve, any more; nor is it in a position to persuade the Saudis to restore productions as it no longer talks to Russia over the issue. President Biden, however, so far failed to have the ear of Mohammad bin Salman, Saudi Crown Prince - the de factor leader of the Kingdom and that of the OPEC+.

In this context, analysts keep wondering whether President Biden has anything up his sleeve to bring the energy prices down to a sustainable level before it is too late.